Tax the Rich: Implementing a State Tax on Investment Gains

Tax the Rich: Implementing a State Tax on Investment Gains

Introduction

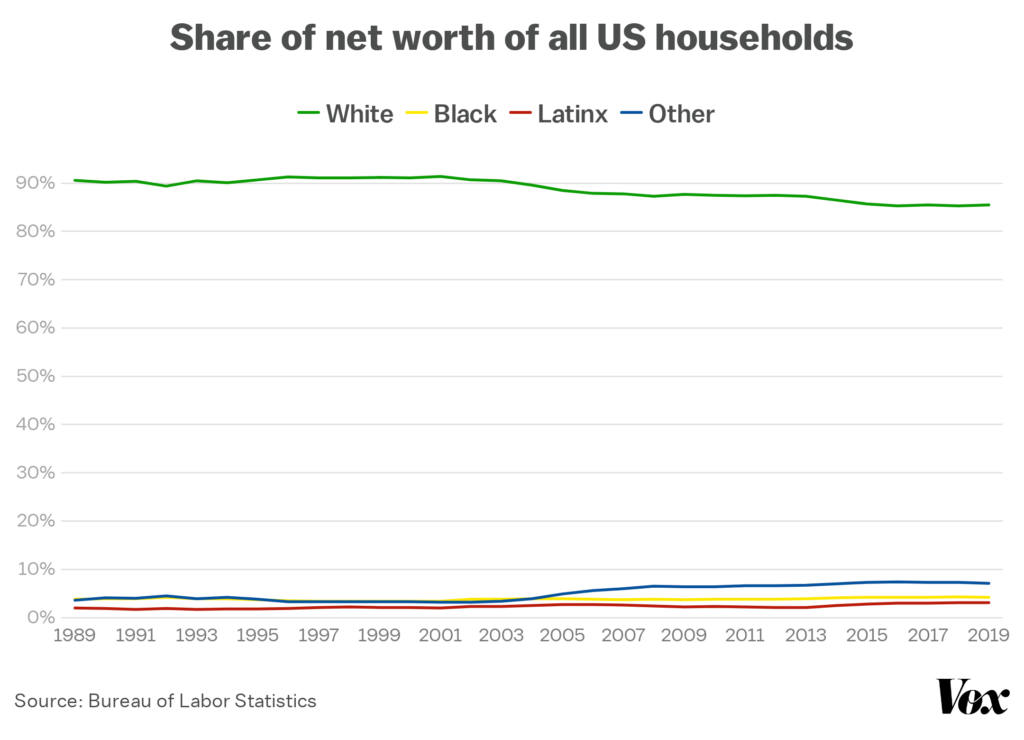

The concentration of wealth in the hands of the elite few impacts every facet of our lives. It is directly connected to expanding wealth disparities and the rising cost of living, the existential climate crisis and the rampant expansion of authoritarianism, and it threatens the very existence of the multiracial democracy that we strive for.

This concentration of wealth did not happen by accident; it is not the result of inevitable forces. It is a product of deliberate policy choices over decades and centuries. Billionaires and centi-millionaires (those with at least $100 million in wealth) in America are amassing wealth, with a record 700% increase in inflation-adjusted unrealized capital gains over the last three decades.

Racism, sexism, and classism are entrenched in our current economic system, by design. As a result, Black, immigrant, and Indigenous people, working class and rural communities, women, and queer people are disproportionately exploited and denied prosperity by our economic policies. Some of these problems could be mitigated if the extremely wealthy paid their fair share toward meeting vital social needs, particularly in terms of spurring opportunities for communities experiencing structural poverty. For example, considerable research has shown that high-quality preschool can play an enormous role in helping every child reach their potential. Given the scale of wealth involved, getting the extremely wealthy to pay their fair share in taxes could raise substantial revenues toward vital initiatives like this.

Unfortunately, the absurd regressivity that is evident at the very top of our tax system at the federal level is even more evident at the state level. This is partly because income taxes, as currently designed at the federal and state level, do not reach unrealized gains. For example, billionaire Jeff Bezos was paid about $1.7 million in total compensation by Amazon in 2022, but his net worth in 2023 increased by a massive $70 billion, which amounts to almost $8 million per hour. Furthermore, states have not levied taxes on broad forms of wealth for almost a century, while other countries, including Switzerland since 1848 and Norway since 1892, have retained their wealth taxes. The extremely wealthy in America have employed armies of lobbyists to ensure that their effective tax rates are kept low and that neither federal nor state taxing authorities can effectively tax intergenerational wealth transfers.

Historically, state legislators, in collaboration with the communities most impacted by these policy choices, have led the fight in challenging corporate and billionaire power by organizing communities and building economies that empower people. Modernizing the tax code is an essential piece of this vision. Taxing unrealized gains, in particular, offers an opportunity to reverse the increasingly widening wealth disparities in the United States and to fund our future.

Note on Terminology Unrealized gains are the increased value of assets that have not yet been sold (or “realized”). |

Wealth Tax Overview

Wealth includes ownership of many different types of assets, including real estate, vehicles, and art, but the largest category among the very rich is ownership of businesses, stocks, and mutual funds. Through a series of tax loopholes dubbed “buy, borrow, die,” the ultra-wealthy can hold on to and use financial securities as collateral for loans (often securities-backed lines of credit) instead of selling investments to cover expenses. The loopholes also allow their inheritors to receive these financial assets on a legally allowed “stepped-up” basis (i.e., based on valuing the inherited stock at the current market value) without paying any capital gains taxes (McCaffery, 2019). This means that all inherited capital gains are provided a tax benefit that would not be allowed if someone sold off their financial securities before their death. To make matters worse, the ultra-wealthy would only need to retire and/or move to a state that does not tax income before realizing their capital gains to avoid state taxation (Galle et al., in press).

For example, although Jeff Bezos relied on public investments in physical and human capital infrastructure in Washington State to establish Amazon, he waited until he moved to Florida (a state without a capital gains tax) before selling $2 billion in Amazon stock, depriving Washington of almost $600 million in state revenue. It is imperative that unrealized gains are taxed, or the massive income and wealth inequalities in our country will continue to grow unabated, with the impacts disproportionately felt by communities structurally denied opportunities (Addo & Darity, 2021).

Note on Securities-Backed Line of Credit (SBLOC) SBLOC is the most common way to borrow in the “buy, borrow, die” scheme and is similar to a home equity line of credit, but financial investments are the collateral instead of real estate. SBLOC’s advantages include: (1) no capital gains taxes, (2) flexible repayment schedules, (3) simple and low-cost approval process, and (4) relatively low interest rates. |

While no state currently has a wealth tax on a broad range of assets, the U.S. does levy taxes on some forms of wealth. Property taxes are an example of taxing assets before they are sold, though overall the property tax is regressive. Another example is the federal expatriation tax, which includes a tax on net unrealized capital gains for individuals with a net worth of at least $2 million who have relinquished their U.S. citizenship. As tax codes are common but can be complicated, the policy design and implementation of a new wealth tax model could benefit from the experience of other countries, from academics who have spent time researching these models, and from state legislation at the forefront of this reform in this country.

The following is a policy design discussion focused on taxing one major category of wealth: unrealized capital gains. This discussion pulls primarily from academic sources and focuses on real-world policy decisions. This is not meant to serve as “model” language, but instead to provide policy design considerations and options that policymakers should discuss with local movement groups and impacted communities.

Notes on Income vs. Wealth “Income is the sum of earnings from a job or a self-owned business, interest on savings and investments, payments from social programs and many other sources. It is usually calculated on an annual or monthly basis. Wealth, or net worth, is the value of assets owned by a family or an individual (such as a home or a savings account) minus outstanding debt (such as a mortgage or student loan). It refers to an amount that has been accumulated over a lifetime or more (since it may be passed across generations).” (Source: Pew Research Center) Realized capital gains are considered income, and unrealized capital gains are sometimes understood as a form of future income. But as these gains are part of assets that the wealthy can use as collateral, we refer to them in this report as a form of wealth, and a tax on unrealized capital gains as a type of wealth tax. Please note: The case Moore v. United States was argued in the Supreme Court in part to decide whether unrealized gains can be treated as income from a federal tax perspective, but states are not necessarily limited by this ruling, as it is focused on Congress’ power of taxation under the 16th Amendment. |

Types of Assets Included (or Exempted) and Asset Valuation

The first and perhaps most impactful policy design decision is which types of assets to include as taxable forms of wealth. The broadest definition of wealth includes total net assets, or the market value of all financial and nonfinancial assets after debt. For example, a French wealth tax exempts business assets, shares acquired from capital subscription (e.g., agreement to purchase an IPO), artwork, antiques and collectibles, and intellectual property, and is calculated by taxpayers based on the market value of all their other assets (Garbinti et al., 2023). A U.S. example of a broad wealth tax is 2023 CA AB 259, which, if enacted, would eventually apply a 1% tax on worldwide net worth in excess of $50 million and 1.5% on net worth over $1 billion. Care should be taken when considering what types of assets to exempt, as one study found that European wealth taxes that exempted wealth from owner–manager businesses created a tax loophole for the ultra-rich (Piketty et al., 2023).

Note on Financial Assets “Financial assets include fixed-claim assets (checking and saving accounts, bonds, loans, and other interest-generating assets), corporate equity (shares in corporations), and noncorporate equity (shares in noncorporate businesses, for instance, shares in a partnership). Financial assets can be held either directly or indirectly through mutual funds, pension funds, insurance companies, and trusts.” (Saez & Zucman, 2020) |

Unrealized Capital Gains

While wealth takes many forms, proposals by advocates, academics, and policymakers in the U.S. have primarily focused on taxing one category of wealth: unrealized capital gains. Not only is this form of wealth massive (estimated at $8.5 trillion nationally), but it is likely the most politically feasible to address and the least complicated to tax as well. A tax on unrealized capital gains is a relatively simple idea, but there are several policy design options that interested state policymakers and advocates can consider. Many of these proposals assess the value of unrealized capital gains based on gains or losses relative to a year-end market value, also referred to as mark-to-market. Two of the issues around a tax on unrealized capital gains using mark-to-market valuation are the price volatility of financial markets and the uncertain valuation of illiquid assets (Saez et al., 2021).

S&P 500 Historical Annual Returns

(Source: Macrotrends, LLC)

For example, looking at the history of S&P 500 returns above, how can a state budget office develop accurate revenue forecasts when the financial markets shift so quickly? The following policy options include unrealized capital gains tax designs that would help to address these mark-to-market tax concerns.

Unrealized Capital Gains Tax Terminology “Cost basis” is the original purchase price that the asset was acquired for and is used to calculate net gains or losses. “Deemed realized gains” are unrealized gains (or built-in gains) that are treated as realized for tax purposes and therefore potentially subject to taxation. “Exemption threshold” is the amount of net wealth exempted from taxation (e.g., the first $10 million) and therefore determines who the tax applies to. “Realized capital gains” are the profits from the sale of an asset, calculated as the amount received for the sale minus the cost basis. “Recognized gains” are the amount of realized or deemed realized gains that are subject to taxation (e.g., after subtracting deferred gains). “Tax limit” is the maximum amount of tax on a given asset (also referred to as a “cap”). |

Phased Mark-to-Market Unrealized Capital Gains Tax

A relatively straightforward proposal for taxing unrealized capital gains is to tax a portion of the increase in value of the underlying asset by comparing the current fair market value at a given point in time to the original purchase price (i.e., mark-to-market). One way to do this is to phase in the tax by effectively recognizing only a portion of the deemed realized gains every year. This phased-in approach reduces the risk of volatility inherent in a mark-to-market tax, as only a portion of financial assets would be taxable in a given year. Academic writing on this idea proposes that 50% of deemed realized gains should be recognized as taxable income, which would effectively include 50% of these shares as taxable income in tax year 1, 25% (half of 50%) in tax year 2, 12.5% in tax year 3, and so on (Gamage & Shanske, 2022). The percentage of deemed realized gains to recognize for tax purposes is a policy decision: a larger percentage would raise tax revenue more quickly and reduce the risk of the extremely wealthy using lobbyists to weaken the tax code, while a smaller percentage would minimize tax revenue volatility and the concern of impacting illiquid taxpayers (Gamage & Shanske, 2022).

Legislative Example: Phased Mark-to-Market

Legislative Example: Phased Mark-to-Market

Vermont (2024 VT HB 827)

Under this bill, Vermont taxpayers with net assets in excess of $10 million (the exemption threshold) would be required to include 50% of their unrealized capital gains (i.e., deemed realized gains) in their taxable income for the year, as if all assets had been sold at fair market value on the last day of the year. This taxable amount has an annual tax limit that cannot exceed 10% of the taxpayer’s net assets in excess of $10 million (Gamage, 2024). The bill also provides for an exclusion of $1 million per category of assets (e.g., real estate, nondistributed interest in a trust, and personal property, such as vehicles or art/collectibles) when calculating the net assets for the tax limit. This helps to simplify the valuation process, as a wealthy individual would only need to assess significant asset holdings, which may have already been done for insurance purposes. This bill does not apply a specific tax rate, but instead adds deemed and recognized capital gains to taxable income for individual income tax calculations. The bill also proportionally reduces the tax for residents who have lived in the state for less than 4 years.

Calculation Example: Phased Mark-to-Market Income deemed realized and recognized:

Tax limit/phase-in cap amount:

The lower amount from these two calculations, $2 million, is added to taxable income. All else being equal (assuming no other taxable income or tax credits/deductions) and assuming a Vermont income tax of $17K + 8.75% of taxable income over $279K, this would result in a state income tax of about $168K. |

Calculation Example: Phased Mark-to-Market for Jeff Bezos If Jeff Bezos paid this type of unrealized capital gains tax on Amazon shares he owns:

The lower amount from these two calculations, $19.849 billion, is added to taxable income. As above, all else being equal and assuming a Vermont income tax of $17K + 8.75% of taxable income over $279K, this would result in a state income tax of about $1.737 billion. |

Withholding Tax on Unrealized Capital Gains

Another policy option is to require extremely wealthy individuals to prepay future realized capital gains taxes through a type of withholding tax (i.e., “pay-as-you-go,” where a portion of estimated tax is sent periodically to the taxing authority before the full amount is due) on unrealized capital gains. This estimated prepayment could be based on the value of unrealized capital gains above a specific exemption threshold, which could be set high enough to not target illiquid millionaires and could also include progressive tax rates based on the amount of unrealized capital gains (Saez & Zucman, 2020). An academic proposal of this withholding tax includes both liquid and illiquid assets (except for retirement accounts) and recommends that the withholding tax rate be one-tenth of the top federal capital gains tax rate (Saez et al., 2021). As with the phased tax above, compared to traditional wealth tax models, the withholding tax model would help to smooth out asset valuation volatility, which is especially important to states, as they are required to enact balanced budgets (Saez et al., 2021).

Valuing Private Businesses/Unlisted Shares

One area of asset valuation that warrants careful consideration is shares of private businesses, which is a major asset class for many of the ultra-wealthy (Saez & Zucman, 2020). In France, the tax administration provides guidelines on how taxpayers can value stocks from unlisted companies (Garbinti et al., 2023). There are many ways that states could consider valuing unlisted shares.

Large Private Businesses. For large private businesses, the value could be based on secondary market valuation, such as by venture capitalists, private equity funds, financial analysts, or recent stock trades (Saez et al., 2021). For wealthy individuals who are unable or unwilling to sell their private shares to cover a tax on unrealized capital gains, a government-run credit program could be created to provide taxpayers with government loans, secured by their illiquid assets, with interest accrued at the Treasury rate and repayment triggered when either the asset becomes liquid or control of the asset is transferred to another party (Saez et al., 2021).

Small Private Businesses. Shares in small private companies could be valued using a straightforward formula based on book value, sales, and profits; for example, Switzerland has successfully used this type of formula (Saez & Zucman, 2020). By utilizing a formula with easily available information, small private businesses would not incur significant administrative costs if one of their owners were subject to an unrealized capital gains tax. Data on small business employee size shows that over 80% of small businesses have zero employees and another 16% have only 1–19 employees, and additional data on business owners reveals that private businesses with more than five employees are owned by families with a median net worth of only $1.25 million and median business assets of $400K. It is clear that relatively few small businesses would need to be valued, and the ultra-wealthy likely have accountants who track basic financial data on their small businesses, which might be needed when selling these businesses or using them as collateral for a loan. Valuation of defined benefit pension plans could also be based on a simple formula that looks at age, tenure, and current salary to approximate accrued benefits (Saez & Zucman, 2020).

Calculation Example: Swiss Private Business Valuation Formula The value of private businesses in Switzerland is calculated as a three-year average of current net asset value (i.e., total assets minus total liabilities) and a three-year average based on a double weighted and capitalized earnings value. This sounds more complicated than it is. The formula is: Business Value = [(Average of 3 Years of Adjusted Net Profits) x 2 + Net Asset Value] x 1/3 Capitalization Rate Let’s suppose that this model is used in the U.S. and a private company had a net asset value of $10 million at the end of 2023 and adjusted net profits of $1 million in 2021, $2 million in 2022, and $3 million in 2023. Let’s also assume a capitalization rate (i.e., expected rate of return) of 8%, which would be determined by statute or regulation. This formula results in a total valuation of $20 million: 2023 Business Value = [(($1M +$2M + $3M)/3) x 2) + $10M] x 1/3 = $20M 0.08 Source: Eckert & Aebi (2020) |

Legislative Examples: Business Valuation

Legislative Examples: Business Valuation

Both a California bill and a Vermont bill use a straightforward business valuation formula of book value plus 7.5 times book profits in a given year. In particular cases, certified appraisal values can be used to determine the worth of private business assets.

____________________________________________________________________________________________________

California (2023 CA AB 259)

50308. (c) (3) (D) For purposes of this part, if a valuation is to be calculated by the proxy valuation formula for business entities, that valuation shall be the book value of the business entity according to GAAP plus 7.5 times the book profits of the business entity for the taxable year according to GAAP. However, if the taxpayer can demonstrate with clear and convincing evidence that a valuation calculated via the proxy valuation formula would substantially overstate the value as applied to the facts and circumstances for any taxable year, then the taxpayer can instead submit a certified appraisal of the value of the taxpayer’s ownership interests in the business entity for that year and use that certified appraisal value in place of applying the primary valuation rules of subparagraph (F) or (G).

[...]

(F) For business entities for which the valuation calculated by the proxy valuation formula for business entities is less than fifty million dollars ($50,000,000), the value of the taxpayer’s ownership interests in the business entity will be presumed to be the percentage of the business entity owned by the taxpayer multiplied by the valuation calculated by the proxy valuation formula for business entities.

(G) For business entities for which the valuation calculated by the proxy valuation formula for business entities is fifty million dollars ($50,000,000) or greater, the taxpayer shall submit a certified appraisal of the value of the taxpayer’s ownership interests in the business entity. The value of the taxpayer’s ownership interests in the business entity will then be presumed to be the greater of the following:

(i) The certified appraisal value.

(ii) The percentage of the business entity owned by the taxpayer multiplied by the valuation calculated by the proxy valuation formula for business entities.

____________________________________________________________________________________________________

Vermont (2024 VT HB 827)

5604. (c) (3) (D) Except for assets and entities governed by subdivisions (1) and (2) of this subsection (c), assets excluded under subdivision (A) of this subdivision (3), and assets attached to an ODA, for all other interests in any business entities including all equity and other ownership interests, all debt interests, and all other contractual or noncontractual interests, the fair market value of those interests at the end of any tax year shall be presumed to be the sum of the book value of the business entity according to generally accepted accounting principles for the tax year plus a present-value multiplier of 7.5 times the book profits of the business entity for the tax year according to generally accepted accounting principles, with this entire sum then multiplied by the percentage of the business entity owned by the taxpayer as of the end of the tax year. However, if the taxpayer can demonstrate with clear and convincing evidence that such a presumption would substantially overstate the fair market value, the taxpayer may instead submit a certified appraisal and then use the certified appraisal value as the fair market value.

Indirectly Held Assets. Another consideration is how to deal with assets that are held by trusts or other intermediaries. To reduce tax avoidance, experts recommend that intermediary assets that are controlled by or for the benefit of wealthy individuals be included in a wealth tax, but allocated based on different levels of priority so that the impact is on the wealthiest individuals who control the funds and much less on nontaxable charities that use trust funds for programmatic purposes (Saez & Zucman, 2020). For example, the trust would be responsible for any tax liability related to trust assets unless the beneficiaries receive all of its income distributions, in which case the entire trust would be subject to the withholding tax (Saez et al., 2021).

Legislative Example: Assets in a Trust

Legislative Example: Assets in a Trust

A bill in Washington State specifies how to treat the assets of a trust depending on who benefits from or has control over the trust, as well as what happens when intangible assets are transferred to a minor relative.

____________________________________________________________________________________________________

Washington (2023 WA HB 1473/SB 5486)

Sec. 3. TAX IMPOSED. […] (4) The tax imposed in this section does not apply to a resident based on that person’s status as a trustee of a trust, unless that person is also a beneficiary of the trust or holds a general power of appointment over the assets of the trust.

(5)(a) If an individual is treated as the owner of any portion of a trust that qualifies as a grantor trust for federal income tax purposes, that individual must be treated as the owner of that property for purposes of the tax imposed in this section to the extent such property includes intangible assets.

(b) A grantor of a trust that does not qualify as a grantor trust for federal income tax purposes must nevertheless be treated as the owner of the intangible assets of the trust for purposes of the tax imposed in this section if the grantor’s transfer of assets to the trust is treated as an incomplete gift under Title 26 U.S.C. Sec. 2511 of the internal revenue code and its accompanying regulations.

(6) Intangible assets transferred after the effective date of this section by a resident to an individual who is a member of the family of the resident and has not attained the age of 18 must be treated as property of the resident for any calendar year before the year in which such individual attains the age of 18.

Unliquidated Tax Reserve Account (ULTRA)

Another option for taxing assets that are difficult to value is to allow wealthy taxpayers to grant the government a “notional equity interest” on the assets in lieu of a tax payment (Galle et al., 2022). This interest would not confer any voting rights and would only be used for future valuation, as the taxing authority would only receive funds after the assets are sold/liquidated. If the value of the assets rises or falls, the government’s eventual tax revenue would also rise or fall, as it is effectively pegged to the stock’s value, not a set dollar amount. If a taxpayer holds on to these assets for several years, they could defer the tax payments by granting additional equity interest to the government. To address concerns that the wealthy will take advantage of this delay in taxation by lobbying for tax code changes instead of paying their fair share, this policy option could be designed in a way that would only allow taxpayers with liquidity challenges (e.g., all of their wealth is in a single private stock) to defer paying a wealth tax on difficult-to-value assets until their private stocks/assets are sold (Galle et al., 2022). The extremely wealthy, who do not face these liquidity issues, could instead be required to prepay a portion of their deferred tax every year (Galle et al., 2022).

Calculation Example: ULTRA “Ownership” For example, for a 2% unrealized capital gains tax on private stock, the taxpayer could instead provide the government with 2% “ownership” of these assets. If the taxpayer holds on to these stocks, they begin the second tax year with 98% ownership of the private stock (since, in the first tax year, they chose to grant the government 2% notional equity interest in lieu of a tax payment), and therefore the government would receive an additional 1.96% equity interest (i.e., 2% of 98%), for a total of 3.96%. |

Legislative Example: ULTRA

Legislative Example: ULTRA

A version of an ULTRA was written into a California bill as a liquidity-based optional unliquidated tax claim agreement (LOUTCA).

____________________________________________________________________________________________________

California (2023 CA AB 259)

50310. (a) Liquidity-based Optional Unliquidated Tax Claim Agreements, to be referred to as LOUTCAs, shall be governed by the following rules:

(1) Taxpayers who are specified as liquidity-constrained taxpayers and who have ownership interests in designated highly illiquid assets, such as startup business entities, shall be able to elect to initiate a LOUTCA to be attached to their ownership interests in those designated highly illiquid assets instead of the net value of those ownership interests or the net value of those assets being assessed at the end of a tax year.

(2) Any taxpayer subject to the tax imposed by this part is presumed to not be specified as a liquidity-constrained taxpayer if the taxpayer’s designated highly illiquid assets are less than 80 percent of the taxpayer’s total net worth. The Franchise Tax Board may adopt regulations in regard to substantiating who is a specified liquidity-constrained taxpayer and in regard to what is a designated highly illiquid asset. It is the intent of the Legislature that most taxpayers subject to the tax imposed by this part should not be specified as liquidity-constrained taxpayers and that publicly traded assets and ownership interests conferring control rights in substantially profitable privately held business entities shall not be designated as highly illiquid assets.

(3) To initiate any LOUTCA, a taxpayer shall sign forms to be created by the Franchise Tax Board that shall have the effect of creating a binding contractual agreement between the taxpayer and the state. A LOUTCA shall be legally binding on the taxpayer, and also on the taxpayer’s estate and assigns, until such time as either the taxpayer or the taxpayer’s estate reconciles the LOUTCA so as to fully liquidate the accumulated tax claims and to then pay all tax due on those liquidated tax claims.

Exemptions, Deductions/Credits, and Limits

As with most taxes, a key policy decision is to determine what amount of a taxable asset should be exempted (i.e., the asset threshold) and what specific tax deductions or credits should be allowed.

Exemption Threshold

A national wealth tax in France, for example, included all French residents and potentially all worldwide assets above a €1.3 million threshold (Garbinti et al., 2023). One study found that having a low exemption threshold (e.g., €1 million) created political opportunities for opponents to highlight cases of illiquid millionaires struggling to pay their wealth tax (Piketty et al., 2023). Applying that lesson, a wealth tax proposed by U.S. Sen. Elizabeth Warren had a $50 million threshold and applied a 2% wealth tax rate up to $1 billion in wealth and a 3% tax rate after that (Saez & Zucman, 2020). An academic paper also proposes a $50 million exemption threshold, which would impact the top 0.05% wealthiest families, or about 100,000 households (Saez et al., 2021).

Legislative Examples: Phase-In Cap

Legislative Examples: Phase-In Cap

Another taxation limit introduced in recent state legislation is a “phase-in cap amount” to limit the amount of unrealized net gains subject to taxation. For example, a bill in New York would set a phase-in cap of 25% of net assets above a $1 billion exemption threshold, and a bill in Vermont would set a phase-in cap of 10% of net assets above a $10 million exemption threshold.

____________________________________________________________________________________________________

New York (2023 NY SB 1570)

612-a. (b) Subsequent to two thousand twenty-three, resident individual taxpayers with net assets that are worth one billion dollars or more at the end of the last day of any tax year shall recognize gain or loss as if each asset owned by such taxpayer on such date were sold for its fair market value on such date, but with adjustment made for tax paid on gain in previous years. Any resulting net gains from these deemed sales, up to the phase-in cap amount, shall be included in the taxpayer’s income for such taxable year. […]

(c) For each date on which gains or losses are recognized as a result of this section, the phase-in cap amount shall be equal to a quarter of the worth of a taxpayer’s net assets in excess of one billion dollars on such date.

____________________________________________________________________________________________________

Vermont (2024 VT HB 827)

5601. (4) “Phase-in cap amount” means an amount equal to 10 percent of the worth of a taxpayer’s net assets in excess of $10,000,000.00 at the end of the day on the last day of an applicable tax year.

[...]

5602. TAXATION OF UNREALIZED GAINS (a) Tax is imposed for each taxable year on resident individuals with net assets worth more than $10,000,000.00 at the end of the day on December 31 of the taxable year. A taxpayer shall be deemed to realize 50 percent of the gain or loss as though each asset owned was sold for fair market value at the end of the day on that date. A proper adjustment shall be made for assets previously subject to taxation under this section in prior years, pursuant to subsection (b) of this section. All other adjustments to the basis of a taxpayer’s assets shall be made prior to a partial deemed sale under this section. Any resulting net gains from a partial deemed sale, up to the phase-in cap amount, after accounting for losses carried forward, shall be recognized and included in the taxpayer’s taxable income for that taxable year.

Deductions and Credits

The withholding model referenced earlier differs from a basic wealth tax, such as the property tax, in that it allows the withholding to be used as a tax credit when financial assets are sold and capital gains are realized (Saez & Zucman, 2020). This tax credit could have a “withholding account” that carries forward until any of the taxpayer’s financial assets are sold and capital gains are realized (Saez et al., 2021). This way, there is no risk of double taxation, as these capital gains are only taxed once.

Similar to the withholding model, the ULTRA policy option would provide that any prepayment of a deferred wealth tax would generate a tax credit that could be applied against a future tax liability from the sale of a difficult-to-value asset (Galle et al., 2022). In order to take into account individual contributions to assets by wealthy individuals, the percentage of the government’s “stake” in assets that increase due to financial contributions could also be added to the tax credit (Galle et al., 2022).

Calculation Example: ULTRA Tax Credit Let’s assume that a wealthy individual has difficulty valuing shares of a private company and signs an ULTRA agreement with the government. If, over time, the government builds up a notional equity interest of 10% of those shares and the wealthy individual buys an additional $50 million in that stock, then $5 million (10% of $50 million) could be applied as a tax credit when the stock is sold. If, soon after, the wealthy individual sells their ownership in this private company for $200 million, then the government would be entitled to $15 million (10% of the $200 million minus the $5 million credit). |

Tax Limit

There are many ways that a tax limit can be designed. For example, the French wealth tax provides a tax ceiling of 75%–85% of net taxable income (Garbinti et al., 2023). The phase-in example mentioned earlier includes an annual tax limit of 10% of the taxpayer’s net assets in excess of $10 million. And an academic proposal for a withholding tax on future capital gains proposes limiting the withholding to 90% of the potential federal capital gains tax, which would be accumulated over a nine-year period (Saez et al., 2021). See below for more on this model.

Decision Tree: Withholding Tax on Unrealized Capital Gains

Withholding Tax Example for Jeff Bezos

|

Adjusting the Cost Basis

To ensure that unrealized capital gains are not taxed twice, one policy option is to adjust the cost basis (i.e., the cost used to calculate gains/losses) of these assets based on deemed realized gains or losses. For example, 2024 VT HB 827 would increase the cost basis of assets with deemed realized gains by the amount of gains that are actually recognized, which is the lesser of 50% of total deemed capital gains or the cap amount plus any gains that were offset with the deemed capital losses. This basis increase is proportionally allocated among all assets with deemed capital gains based on their share of total gains. To ensure that deemed capital losses are not taken into account more than once, the bill provides for reducing the basis of these assets by the amount of their recognized deemed capital losses (Gamage, 2024).

Adjusted Cost Basis Example for Jeff Bezos Going back to our example of a phased mark-to-market tax on Jeff Bezos:

The lower amount from these two calculations, $19.849 billion, would again be added to the taxable income and to the cost basis of the Amazon stock shares (for tax year 3). Eventually, all else being equal, the cost basis would become large enough to reduce the deemed and recognized realized gains to below the tax limit. |

Tax Administration

While different state revenue agencies promulgate administrative rules to implement their state’s unique tax code, there may be additional lessons to learn regarding how to design strong reporting requirements and enforcement tools.

Reporting Requirements

In the French tax system, taxpayers were required to report their wealth tax based on January 1st of the reporting year (Garbinti et al., 2023). For example, if a wealthy taxpayer was filing income tax forms in 2023 for income earned in tax year 2022, they would also complete wealth tax forms for assets as of January 1, 2023 (not 2022). The French tax system provided both a regular tax form and a simplified form for individuals without exemptions or deductions, but a recent study found that simplified reporting may lead to more misreporting of wealth (Garbinti et al., 2023).

A mark-to-market unrealized capital gains tax could follow current tax reporting practices, in which financial institutions share information on assets directly with customers/taxpayers and some third-party reports are shared with the IRS (Saez et al., 2021). This would require filing a new tax form and reporting to the state tax administration both the purchase price and the fair market value of financial assets held by the very wealthy, in order to estimate the taxable value of these unrealized capital gains (Saez et al., 2021). IRS Form 8854, which is used to calculate the federal expatriation tax, is an example of a mark-to-market calculation. Bank valuation of financial securities used as collateral for loans made as part of the “buy, borrow, die” loophole could also be reported to the relevant state tax authority.

Legislative Examples: Tax Forms

Legislative Examples: Tax Forms

An Illinois bill would require the state’s department of revenue to create or amend relevant tax forms, and the bill specified asset categories to include in these forms. A California bill with an ULTRA provision included additional reporting requirements that apply even if residents move to another state, as well as requirements placed on a deceased taxpayer’s estate.

____________________________________________________________________________________________________

Illinois (2023 IL HB 3039)

(a) The Department of Revenue shall amend or create tax forms as necessary for the reporting of gains by assets. Assets shall be listed with (i) a description of the asset, (ii) the asset category, (iii) the year the asset was acquired, (iv) the adjusted Illinois basis of the asset as of December 31 of the tax year, (v) the fair market value of the asset as of December 31 of the tax year, and (vi) the amount of gain that would be taxable under this Act, unless the Department determines that one or more categories is not appropriate for a particular type of asset.

(b) Asset categories separately listed shall include, but shall not be limited to, the following:

(1) stock held in any publicly traded corporation;

(2) stock held in any private C corporation;

(3) stock held in any S corporation;

(4) interests in any private equity or hedge fund organized as a partnership;

(5) interests in any other partnerships;

(6) interests in any other noncorporate businesses;

(7) bonds and interest bearing savings accounts, cash and deposits;

(8) interests in mutual funds or index funds;

(9) put and call options;

(10) futures contracts;

(11) financial assets held offshore reported on IRS tax form 8938.

____________________________________________________________________________________________________

California (2023 CA AB 259)

50310. (a) (4) If a taxpayer has initiated a LOUTCA in any prior year, until that LOUTCA has been reconciled and closed, the taxpayer shall annually complete and file any form or forms that shall be created by the Franchise Tax Board for the purposes of reporting any material transactions made with regard to the LOUTCA. These reporting requirements shall continue even if and after the taxpayer is no longer a resident and shall then be enforced as a legally binding contract with the state. Failure to file these annual forms shall be treated as a breach of contract and shall also be subject to the same penalties as failure to file income tax forms for residents who are required to file income tax forms. Upon the death of any taxpayer who has initiated a LOUTCA that has not been fully reconciled and closed, that taxpayer’s estate and assigns shall be required to reconcile the LOUTCA so as to fully liquidate the accumulated tax claims and to then pay all tax owed on those liquidated tax claims, treating these claims as an unpaid tax liability of the taxpayer owed to the state.

Enforcement Mechanisms

At the most basic level, the potential revenue from a wealth tax is simply: Tax base = total wealth × top wealth share × (1 − evasion rate) (Saez & Zucman, 2020). Minimizing evasion rates is critical to realizing the full benefits of a wealth tax.

The French wealth tax provided that if a wealthy individual is audited and found to be noncompliant with the wealth tax requirements, they may be required to amend their tax returns for up to the last 10 years, depending on the type of noncompliance issue found (Garbinti et al., 2023). A study looking at European wealth taxes found that tax evasion through the use of offshore accounts was a major detriment, along with weak enforcement due to heavy reliance on self-reported assets, and this study recommends the use of a common reporting standard for offshore assets (Piketty et al., 2023).

Legislative Examples: Penalties

Legislative Examples: Penalties

Legislation in Washington State would impose a penalty of either 30% or 50% for understating asset valuations, depending on the level of understatement or misstatement. The bill would also require audits of a percentage of wealthy taxpayers, with the required minimum ramping up from 10% in 2025 to 20% in 2027. Legislation in California would add claims, records, and statements made to comply with the proposed wealth tax’s reporting requirements to the state’s false claims act, which could result in civil action and treble damages for costs that the state incurs to recover penalties or damages when a false or fraudulent claim is made.

____________________________________________________________________________________________________

Washington (2023 WA HB 1473/SB 5486)

Sec. 10. SUBSTANTIAL WEALTH TAX VALUATION UNDERSTATEMENT PENALTY IMPOSED. (1) Except as otherwise provided in this section, if any portion of an underpayment of tax due under this chapter is due to a substantial wealth tax valuation understatement, there must be added to the tax an amount equal to:

(a) In the case of any substantial wealth tax valuation understatement that is a gross wealth tax valuation misstatement, 50 percent of the portion of the underpayment due to the valuation understatement; or

(b) In all other cases, 30 percent of the portion of the underpayment due to the valuation understatement.

(2) The penalty imposed under subsection (1) of this section does not apply unless the portion of the underpayment attributable to substantial wealth tax valuation understatements for the calendar year exceeds $5,000.

(3) The penalty imposed in this section is in addition to any other applicable penalties imposed under this chapter or chapter 82.32 RCW on the same tax due, except for the penalty imposed in RCW 82.32.090(7).

(4) For purposes of this section, the following definitions apply:

(a) “Gross wealth tax valuation misstatement” means the fair market value of any financial intangible assets reported on a return required by this chapter is 40 percent or less of the amount determined to be the correct amount of such fair market value.

(b) “Substantial wealth tax valuation understatement” means the fair market value of any financial intangible assets reported on a return required by this chapter is 65 percent or less of the amount determined to be the correct amount of such fair market value.

Sec. 11. ENFORCEMENT. Beginning in calendar year 2025, to the extent that sufficient funds are specifically appropriated for this purpose, the department must initiate audits of at least 10 percent of individuals who are registered with the department to pay the tax imposed in this chapter, increasing to 15 percent in calendar year 2026, and 20 percent in calendar year 2027 and thereafter.

This Washington State bill would also add the following language to the statutory section on tax avoidance:

Sec. 16. RCW 82.32.655 and 2010 1st sp.s. c 23 s 201 are each amended to read as follows:

[...]

(d) Arrangements through which a taxpayer attempts to avoid tax under chapter 84A.--- RCW (the new chapter created in section 21 of this act) through intentional deception, such as by concealing assets or evidence of the location of the taxpayer’s domicile in this state, by transferring assets prior to December 31st when the taxpayer effectively retained control of the assets, or by effectively converting taxable assets into nontaxable assets prior to December 31st when the taxpayer engages in a substantially offsetting transaction. This subsection (3)(d) does not apply to substantial wealth tax valuation understatements subject to the penalty in section 10 of this act.

____________________________________________________________________________________________________

California (2023 CA AB 259)

12651. (f) (1) This section shall apply to claims, records, or statements made under Part 27 (commencing with Section 50300) of Division 2 of the Revenue and Taxation Code only if the damages pleaded in the action exceed two hundred thousand dollars ($200,000).

(2) For purposes of this subdivision only, “person” has the same meaning as that term is defined in Section 17007 of the Revenue and Taxation Code.

(3) The Attorney General or prosecuting authority shall consult with the taxing authorities to whom the claim, record, or statement was submitted prior to filing or intervening in any action under this article that is based on the filing of false claims, records, or statements made under the Revenue and Taxation Code.

(4) Notwithstanding Section 19542 of the Revenue and Taxation Code or any other law, the Attorney General or prosecuting authority, but not the qui tam plaintiff, is hereby authorized to obtain otherwise confidential records relating to taxes, fees, surcharges, or other obligations under the Revenue and Taxation Code needed to investigate or prosecute suspected violations of this subdivision from state and local taxing and other governmental authorities in possession of such information and records, and such authorities are hereby authorized to make those disclosures. The taxing and other governmental authorities shall not provide federal tax information without authorization from the Internal Revenue Service.

(5) Any information received pursuant to paragraphs (3) and (4) shall be kept confidential except as necessary to investigate and prosecute suspected violations of this subdivision.

(6) This subdivision does not and shall not be construed to have retroactive application to any claims, records, or statements made under the Revenue and Taxation Code before January 1, 2024.

Withholding Model Enforcement

The unrealized capital gains tax withholding model could potentially reduce the risk of undervaluing financial assets, as this valuation could provide a future tax credit (Saez & Zucman, 2020). Enforcement could be supported by requiring financial institutions and private businesses to disclose relevant purchase prices and market value estimates, as well as valuing financial assets separately from business operations and assets held indirectly through private businesses, which could limit the risk of tax avoidance through shell corporations (Saez et al., 2021).

Another major benefit of this model for state tax collection is that it reduces “wealth flight,” which is more likely after retirement, as wealthy individuals would not be able to avoid paying taxes on their unrealized capital gains during “productive years” and then retire to a state with no income tax to avoid paying taxes on realized capital gains (Saez et al., 2021). Additionally, the tax withholding allowance would presumably only be useful for individuals who realize their capital gains in a state with a similar withholding tax system (Saez et al., 2021). This may mean that an interstate agreement or compact will become an important tool to avoid double taxation and to support cross-state retirement/establishment of residency.

Note on Wealth Flight “It is possible that the tax could encourage successful entrepreneurs to leave early to avoid the tax. For example, a [California] billionaire might decide to move to Florida now to avoid paying the withholding annual 1% tax on his accumulated gains (instead of moving to Florida later before realizing capital gains). However, it is difficult to move while you are still running a business (and moving the headquarters of the business is much more difficult). Therefore, mobility risk is most important for retired billionaires.” (Saez et al., 2021) An analysis by the Center on Budget and Policy Priorities on interstate migration data and academic studies found the following:

|

Conclusion

A state tax on unrealized capital gains is a relatively new proposal in the U.S., but not globally, and academic experts have analyzed the strengths and weaknesses of various wealth tax models and developed innovative mechanisms to address some of the greatest challenges to practical implementation and political viability. These lessons can provide state policymakers with a starting point for policy design, but as “laboratories of democracy,” state legislatures should prioritize both collaborating with their communities and fostering a spirit of experimenting with, evaluating, and improving their state’s tax revenue laws.

The State Innovation Exchange (SiX) exists to advance a bold, people-centered policy vision in every state in this nation by helping vision-aligned state legislators succeed after they are elected. If you are working to strengthen our democracy, fight for working families, advance reproductive freedom, defend civil rights and liberties, or protect the environment, reach out to helpdesk@stateinnovation.org to learn more about SiX’s tailored policy, communications, and strategy support and how to join this network of like-minded state legislators from across the country.

Academic References

- Addo, F. R. & Darity, W. A. (2021). Disparate recoveries: Wealth, race, and the working class after the great recession. The Annals of the American Academy of Political and Social Science, 695(1), 173–192. https://doi.org/10.1177/00027162211028822

- Chamberlain, E. (2020). Wealth taxes in foreign countries. U.K. Wealth Tax Commission Background Paper, No. 130. https://www.wealthandpolicy.com/wp/BP130_Countries_Table.pdf

- Eckert, J. B. & Aebi, L. (2020). Wealth taxation in Switzerland. U.K. Wealth Tax Commission Background Paper, No. 133. https://www.wealthandpolicy.com/wp/BP133_Countries_Switzerland.pdf

- Galle, B. D., Gamage, D., & Shanske, D. (2022). Solving the valuation challenge: the ULTRA method for taxing extreme wealth. Duke Law Journal, 72, 1257. https://ssrn.com/abstract=4036716 or http://dx.doi.org/10.2139/ssrn.4036716

- Galle, B. D., Gamage, D., & Shanske, D. (in press). Money moves: Taxing the wealthy at the state level. California Law Review. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4722043

- Gamage, D. (2024). Testimony on Vermont H. 827: An act relating to applying personal income tax to unrealized gains. University of Missouri School of Law Legal Studies Research Paper, No. 2024-02. https://ssrn.com/abstract=4726478

- Gamage, D. & Shanske, D. (2022). Phased Mark-to-Market for Billionaire Income Tax Reforms. Indiana University Legal Studies Research Paper, 492. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4268368

- Garbinti, B., Goupille-Lebret, J., Munoz, M., Stantcheva, S., & Zucman, G. (2023). Tax design, information, and elasticities: Evidence from the French wealth tax. NBER Working Paper Series. https://gabriel-zucman.eu/files/GGMSZ2023.pdf

- McCaffery, E. J. (2019). The death of the income tax (or, the rise of America’s universal wage tax). USC Law Legal Studies Paper, No. 18-26. http://dx.doi.org/10.2139/ssrn.3242314

- Piketty, T., Saez, E., & Zucman, G. (2023). Rethinking capital and wealth taxation. Oxford Review of Economic Policy. https://eml.berkeley.edu/~saez/PikettySaezZucman2022RKTrevised.pdf

- Saez, E., Yagan, D., & Zucman, G. (2021). Capital gains withholding. https://gabriel-zucman.eu/files/SYZ2021.pdf

- Saez, E. & Zucman, G. (2020). Progressive wealth taxation. Brookings Papers on Economic Activity, Fall. https://www.brookings.edu/wp-content/uploads/2020/10/Saez-Zuchman-final-draft.pdf

Anti-Racist State Budgets: Progressive Revenue

This primer is part of a series on anti-racist state budgets. To understand the concept of creating anti-racist state budgets, it is important to understand the difference between racist and anti-racist ideas and policies. The following excerpts are from How To Be An Antiracist (2019) by Ibram X. Kendi:

Racist vs. Anti-racist Ideas

A racist idea is any idea that suggests one racial group is inferior or superior to another racial group in any way. Racist ideas argue that the inferiorities and superiorities of racial groups explain racial inequities in society. . . An antiracist idea is any idea that suggests the racial groups are equals in all their apparent differences – that there is nothing right or wrong with any racial group. Antiracist ideas argue that racist policies are the cause of racial inequities.

Racist vs. Anti-racist Policies

A racist policy is any measure that produces or sustains racial inequity between racial groups. An antiracist policy is any measure that produces or sustains racial equity between racial groups. . . There is no such thing as a nonracist or race-neutral policy. Every policy in every institution in every community in every nation is producing or sustaining either racial inequity or equity between racial groups.

For additional race-equity concepts and definitions, please visit the Racial Equity Tools glossary webpage.

Overview

We all benefit from funding for education, health care, infrastructure, and other vital services regardless of race, gender, or income level. But the wealthy few have used an army of lobbyists and complicit lawmakers to drive down their own tax rates and to rig the rules. This has created regressive state tax systems that too often exacerbate income inequality across both race and income.[i] In “Progressive Wealth Taxation,” UC Berkeley economists Emmanuel Saez and Gabriel Zucman explained that the top marginal federal income tax rate dropped from more than 70% between 1936 and 1980 to only 37% since 2018, and “when combining all taxes at all levels of government, the U.S. tax system now resembles a giant flat tax.”[ii]

Flat taxes, and even worse, tax codes that levy higher taxes on low- and middle-income families, worsen income inequality and widen the racial wealth gap. Tax structures in 45 states exacerbate income inequality—in the 10 most regressive states, families at the bottom 20% of the income distribution pay up to six times as much in taxes as the state’s wealthiest families.[iii] While the investments made possible by taxes are a powerful force in combating racial inequities, the way those taxes are collected, and from whom, remains deeply inequitable. Regressive state tax policies have deep and lasting roots in anti-Blackness,[iv] and in tandem with discriminatory and exploitative policies that embedded racism across all social and economic systems (e.g., in ownership of land and access to housing, education, and credit[v]), state tax policies have not meaningfully addressed the growing racial wealth gap; and in many states, especially in the South,[vi] these policies actually make racial disparities worse. As of 2016, Black and Latinx families had a median net worth of $17,600 and $20,700, respectively, compared to $171,000 for white families.[vii] A recent study concluded that “if you belong to a historically marginalized racial or ethnic group, your racial status is the stronger predictor of your economic position than your education, income, and in this case, employment status and position.”[viii]

Strong communities and thriving families are built upon a foundation of public investments that benefit us all. Investments in good schools, affordable health care, and transportation infrastructure pay off for everyone. Research shows that higher levels of income inequality create a drag on economic and state tax revenue growth.[ix] States with fairer tax codes enjoy faster economic growth, faster income growth, and increased employment levels than states that are reliant on regressive taxes like sales and excise taxes.[x]

Under a lopsided tax code, a state’s poorest families are paying the most in taxes, while also bearing the brunt of disinvestment when tax revenues decline. During the Great Recession, states slashed education and health care budgets in the face of revenue shortfalls, with lasting consequences for low-income Black, brown, and white communities.[xi] Years of public disinvestment have left the same communities less prepared to weather the COVID-19 public health crisis and future economic downturns. For example, many states have used budget surpluses to push for “shortsighted, costly, permanent tax cuts,”[xii] which leaves these communities more vulnerable to future budget cuts,[xiii] especially as states again grapple with the risk of budget shortfalls.[xiv]

It doesn’t need to be this way; together we can rewrite tax codes to benefit us all. We’ve done this before, so we know that progressive revenue can stimulate economic growth, reduce income inequality, and narrow the gaps in income and wealth created through centuries of racism and discrimination.

Policy Considerations

Policymakers have the power to generate needed revenue by revamping their existing state’s tax codes. They can implement innovative approaches that build a more equitable future and center the needs of communities of color and low-income communities. When considering ways to promote racial equity and reduce wealth inequality in state tax systems, state legislators should refer to the following policy options and work with national and local advocates, especially those groups that center race equity, to develop the best policies for their state.

The wealthy use a range of tax avoidance strategies,[xv] including characterizing income from labor as business income, with pass-through business income in the form of long-term capital gains or dividends, all of which are taxed at a lower rate than ordinary personal income. The wealthy can also defer realizing capital gains and their inheritors can avoid taxes on these gains after they die. As explained by USC professor and tax law expert Edward J. McCaffery in his law journal article “The Death of the Income Tax,” the current tax code is really a wage tax, not an income tax, and those in the 1% of net wealth do not rely on their wages but instead use their assets as collateral to borrow tax-free.[xvi] The uber-wealthy are able to avoid income taxes and create generational wealth by relying on wealth instead of income through a process that McCaffery refers to as “buy, borrow, die.”[xvii] Therefore, we start with one of the most impactful progressive revenue reform ideas to address these loopholes: the wealth tax.

WEALTH TAX

Wealth taxes apply to either an individual’s net worth (total assets net of all debts) or some targeted asset class, which could include financial assets such as bank accounts, bonds, stocks, and/or non-financial assets such as real estate, yachts, sports cars, or other luxury goods. A wealth tax on a household above an exemption threshold is a critical tool for capturing revenue from the most affluent members of society who possess substantial wealth but may have comparatively lower incomes.

It is possible for the wealthiest households to have low taxable income because our tax codes have been designed to allow them to escape taxation in different ways. For example, the tax code does not address unrealized capital gains since until these assets are sold, they are not “taxable income” and thus, much of one’s wealth would not appear on their annual tax returns. (See Center on Budget and Policy Priorities’ report on the issue of special tax breaks for the wealthy for more information.)[xviii]

Estimates from UC-Berkeley professors Saez and Zucman indicated that a federal tax of 2% on net wealth above $50 million and 3% on net worth over $1 billion would only impact 0.1% of (or 75,000) American households and raise $2.75 trillion over a 10-year period.[xix]

Examples of Wealth Tax Legislation

- California took the lead by introducing a first-of-its-kind state wealth tax (2020 CA AB 2088) that would have applied a 0.4% rate to net worth, excluding real estate, in excess of $30 million per household.

- New York legislation (2020 NY SB 8277) would have created a billionaire “mark-to-market” tax[xx] on residents with $1 billion or more in net assets that would treat billionaires’ unrealized capital gains as income. It would have directed revenues from such a tax into a worker bailout fund to assist workers traditionally excluded from employment protection programs by providing them access to unemployment benefits. A similar but simpler version of this bill was later introduced (2021 NY SB 4482/AB 5092) without the worker bailout fund and with some additional changes, and this bill was estimated by advocates to have the potential to raise $23 billion in the first year and $1.3 billion per year thereafter.[xxi]

- Washington legislation (2021 WA HB 1406) would have assessed a modest 1% tax on “financial intangible assets, such as publicly traded options, futures contracts, and stocks and bonds” on wealth in excess of $1 billion (i.e., the first $1 billion is exempt from the wealth tax).

Wealth Tax Design

| An OECD study of European wealth taxes includes the following policy recommendations:[xxii] Low tax rates, especially if the net wealth tax comes on top of capital income taxes;Progressive tax rates;Limited tax exemptions and reliefs;An exemption for business assets, with clear criteria restricting the availability of the exemption (ensuring that real business activity is taking place and that assets are directly being used in the taxpayer’s professional activity);An exemption for personal and household effects up to a certain value;Determining the tax base based on asset market values, although the tax base could amount to a fixed percentage of that market value (e.g., 80%-85%) to prevent valuation disputes and take into account costs that may be incurred to hold or maintain the assets;Keeping the value of hard-to-value assets or the value of taxpayers’ total net wealth constant for a few years to avoid yearly reassessments;Allowing debts to be deductible only if they have been incurred to acquire taxable assets—or, if the tax exemption threshold is high, consider further limiting debt deductibility;Measures allowing payments in installments for taxpayers facing liquidity constraints;Ensuring transparency in the treatment of assets held in trusts;Continued efforts to enhance tax transparency and exchange information on the assets that residents hold in other jurisdictions;Developing third-party reporting;Establishing rules to prevent international double wealth taxation; andRegularly evaluating the effects of the wealth tax. |

ESTATE TAX

Another way states can tax wealth is through an estate tax, which is levied on the estate (money and property) of the most affluent individuals who have passed away. While there is a federal estate tax[xxiii] on estates valued over $12 million (as of 2022), only 12 states and the District of Columbia have their own estate tax.[xxiv] More states have considered implementing this extremely progressive tax because it helps to prevent the growth of “dynastic wealth” by directly targeting the intergenerational transfer of wealth and addressing the racial wealth gap. In 2016, 9 out of 10 households with assets above the federal estate tax threshold of $5.5 million were white.[xxv]

Examples of Estate Tax Legislation

- Washington has a 20% estate tax (WA Stat. § 83.100.040), which is one of the highest rates in the nation, and Washington is the only state without an income tax that levies an estate tax.

- The Hawaii legislature (2019 SB 1361) also increased its top estate tax rate to 20%, which became effective at the start of 2020. For estates over $10 million, the tax is now $1,385,000 plus 20% of the amount the net taxable estate exceeds $10 million.

- Maine (2019 ME LD 420/HP 329) legislators introduced a bill that would have increased their state’s estate tax by lowering the exclusion amount for an inheritance from $5.6 million to $2 million.

INHERITANCE TAX

While an estate tax is a levy on one’s estate, an inheritance tax is levied on those who inherit money or property of a person who has died. Inheritances are a major contributor to growing wealth inequality and disparities between white households and households of color. One reason white families hold more wealth is they are considerably more likely to receive an inheritance, a gift, or additional family support.[xxvi] Specifically, nearly 30% of white families report having received an inheritance or gift, compared to about 10% of Black families, 7% of Hispanic families, and 18% of other families. More robust taxation of inherited wealth not only reduces the transfer of concentrated wealth from one generation to the next, but it also serves as a progressive source of revenue for critical services that we all depend on.

Examples of Inheritance Tax Laws

Only six states impose inheritance taxes. Of these states, Nebraska (NE Stat. 77.2004, 77.2005, and 77.2006) has the highest top rate at 18% as of 2022. The state’s inheritance tax is imposed on all property inherited from the estate of the deceased. The value of such property is based on the fair market value as of the date of death, and the amount of the tax depends upon the recipient's relationship to the deceased. The surviving spouse pays no inheritance tax, children and other close relatives pay a 1% tax beyond an exemption amount, and more distant relatives pay a maximum 13% tax. In all other cases, the rate of tax is 18% on the clear market value of the beneficial interests in excess of $10,000. Unfortunately, recently enacted legislation (2022 NE LB 310) will reduce many of these rates and/or raise the exemption amounts starting in 2023.

The following states also levy a tax on inheritance. See below for details on their tax rates:

- Iowa (IA Code § 450.10) – recently enacted 2021 IA SF 619 will phase out this tax by 2025

- Kentucky (KY Stat. § 140.070)

- Maryland (MD Code § 7.204)

- New Jersey (NJ Stat. § 54.34.2)

- Pennsylvania (1971 PA Act 2 § 2116)

PROGRESSIVE INCOME TAX

When the political realities do not allow for a wealth tax of some kind, an incremental step toward reducing the racial wealth gap is to design state personal income tax systems to better ensure that the wealthiest pay their fair share. As of 2021, nine states do not even have a broad-based state income tax,[xxvii] many of which heavily rely on sales and excise taxes, a practice that the Institute on Taxation and Economic Policy (ITEP) deemed a characteristic of the most regressive state tax systems.[xxviii] States such as California, Minnesota, New Jersey, and Vermont have highly progressive income tax brackets and graduated-rate tax structures that allow them to tax different income at different rates.[xxix] In addition, at least eight states (CA, CT, HI, MD, MN, NJ, NY, and OR) and D.C. have enacted long-lasting millionaires’ taxes since 2000.[xxx] A 2022 ballot initiative in Massachusetts would raise the income tax rate for incomes above $1 million from 5% to 9%.[xxxi]

Examples of Progressive Income Tax Legislation & Ballot Initiatives

The graduated income tax structure ensures the most affluent individuals, who are mostly white,[xxxii] pay a greater percentage of their income in taxes than their lower- and middle-income counterparts.

- The New Jersey legislature passed 2020 NJ AB 10/Chapter 94, which increased the gross income tax rate from 8.97% to 10.75% on income between $1,000,000 and $5,000,000 (this was already the rate for income over $5 million), and provided an annual rebate of as much as $500 for families making less than $150,000.

- There are nine states, including Illinois, that impose a flat income tax.[xxxiii] In 2020, Illinois voters failed to pass a ballot initiative regarding a graduated income tax amendment,[xxxiv] which would have raised approximately $1.4 billion for the rest of the budget year and $3.4 billion over a full 12 months.[xxxv] The amendment would have repealed the state’s constitutional requirement that the personal income tax be a flat rate and instead allow for a graduated income tax.

- Arizona voters approved a 2020 ballot initiative, Proposition 208, to enact a 3.5% income tax, in addition to the existing income tax (4.5% in 2020), on income above $250,000 (single filing) or $500,000 (joint filing).[xxxvi] This initiative was successfully challenged in court by a right-wing advocacy group with ties to the Koch Family and subsequently overturned based on an interpretation of the state constitution. If the new law had survived court challenges, it would have provided additional tax revenue to support teacher and classroom support staff salaries, teacher mentoring and retention programs, and career and technical education programs.

Millionaire Migration/Tax Flight Myth

| This myth refers to the idea that taxing the wealthiest individuals will encourage them to leave and migrate to other states with lower taxes. Anti-tax advocates and politicians often use this myth to advocate for more tax cuts and regressive tax systems. However, the people who tend to move most frequently are not the rich, but instead are typically young college graduates and the lowest income residents who earn below-market incomes and want a better quality of life.[xxxvii] While a very small number of wealthy households may leave as a result of tax increases, migration rates for higher-income earners are low and have little effect on the millionaire tax base.[xxxviii] Research has shown that increasing tax rates on affluent households results in a net positive fiscal impact over time.[xxxix] |

CAPITAL GAINS TAX

States should also consider strengthening their taxes on capital gains income—the profits an investor realizes when selling an asset that has grown in value, such as shares of stock, mutual funds, or real estate investments. The Brookings Institution has a resource on capital gains reforms that discusses the current state of capital gains taxes on a federal level and different ways policymakers can use such taxes as a progressive source of revenue.[xl]

While some states levy a tax on personal income and capital gains at the same rate, as of 2021, nine states provide the wealthiest households with special tax preferences for their capital gains by taxing long-term capital gains at a lower rate than ordinary income.[xli], [xlii] These special tax breaks and preferences prioritize investors’ capital gains income at the expense of the wages and salaries earned by working families and lower-income households of color.

Examples of Capital Gains Tax Legislation

- In Vermont, the legislature passed a bill (2019 VT HB 541) that limits the amount of long-term capital gains a taxpayer can exclude from taxable income to $350,000. Prior to the bill’s passing, Vermont had historically allowed income taxpayers to exclude up to 40% of their capital gains from their taxable income, regardless of the total amount.[xliii]

- Similarly, the New Mexico legislature (2019 NM HB 6 - Section 14) enacted a tax and budget plan that scaled back a tax break for the wealthiest New Mexicans by reducing the portion of capital gains that are exempt from taxation from 50% to 40%. While the 10% deduction is a step in the right direction, the 40% exemption still serves as a large and unnecessary tax break to the highest-income earners—the individuals who already pay the smallest share of their income in state and local taxes. Thus, it is more equitable for states to not just scale back, but eliminate preferences for capital gains income.

- Not only will repealing tax preferences increase revenue for critical public services, but so will creating new surcharges on capital gains. Connecticut lawmakers (2019 CT HB 7415) considered a proposal to levy a 2% surcharge on the capital gains amassed by the wealthiest taxpayers with incomes over $500,000 (for individual filers) and $1 million (for married joint filers). Minnesota (2019 MN HF 2125) also introduced legislation that would have increased the state’s top marginal capital gains tax rate from 9.85% to 12.85%, the second-highest in the country after California (13.3%).

- In Washington, Governor Inslee proposed a capital gains tax on the sale of stocks, bonds, and other assets to increase the share of state taxes paid by Washington’s wealthiest taxpayers.[xliv] Legislation to implement this tax was enacted (2021 WA SB 5096), and the state will apply a 7% tax to capital gains earnings above $250,000 for individuals and $500,000 for joint filers.

- Legislation has been introduced to close the carried interest loophole. Legislation in Maryland (2021 MD SB 288/HB 215) would have imposed a 17% state income tax on the share general partners receive of a pass-through entity’s taxable income that is attributable to investment management services provided in the state. Similarly, bills in Oregon address the carried interest loophole: 2021 OR SB 479 and 2021 OR SB 482 would impose an additional 19.6% state tax on investment services partnership income, which is currently taxed at the lower net capital gains tax rate.

Note on the Carried Interest Loophole

| Investment funds—such as private equity and hedge funds—are often organized as partnerships. These partnerships typically have two types of partners: general partners and limited partners. General partners manage the fund, while limited partners typically only contribute capital to the partnership. General partners can receive two types of compensation: a management fee tied to a percentage of the fund’s assets and a profit share; or “carried interest,” tied to a percentage of the profits generated by the fund. In a common compensation agreement, general partners receive a management fee equal to 2% of the invested assets plus a 20% share in profits as carried interest. The management fee, less the fund’s expenses, is subject to ordinary federal and state income tax rates (the top federal income tax rate for individuals in 2020 is 37%) and the federal self-employment tax. However, taxation of the carried interest is deferred until profits are realized on the fund’s underlying assets, when at such time, the carried interest is taxed [the same] as investment income received by the limited partners. Thus, if the investment income consists solely of capital gains, the carried interest is taxed only when those gains are realized and at a lower capital gains rate on the federal level (the top capital gains tax rate in 2020 is 20%, plus a 3.8% net investment income tax). (Source: Fiscal and Policy Note for 2021 MD SB 288)[xlv] |

EXCESSIVE EXECUTIVE COMPENSATION TAX

In addition to a lack of progressive taxes, another contributing factor to the rise in income inequality is the excessive pay for chief executive officers (CEOs). Rather than raising the wages for their workers, corporations are increasing the wealth of their CEOs who make hundreds—sometimes thousands—of times more than their employees. Research has shown that excessive executive pay is not based on value of a CEO’s work and has a spillover effect that “helps pull up pay for privileged managers in the corporate and even nonprofit spheres.”[xlvi] Policymakers can work to address corporate greed and fight for wealth equity by closing the CEO-worker pay gap through an excessive executive compensation tax.

Examples of Excessive Executive Compensation Legislation

- The Portland, Oregon, City Council was the first in the country to enact a measure (2016 Ordinance 188129) that levies a tax on companies whose CEOs earned more than 100 times the median pay of their average workers. Corporate income tax increases by 10% if a company’s CEO has a salary ratio of above 100:1, and by 25% for companies with pay gaps equal to or exceeding 250:1. This tax generates revenue for the city’s general fund, which pays for essential city services.

- The Washington legislature (2019 WA HB 1681) introduced a bill that would have imposed a surcharge, in addition to business and occupation taxes and public utility taxes, on corporations with excessive chief executive officer pay. Similar to Portland, Oregon’s law, this legislation would have targeted companies with chief executives who were paid more than 50 times the pay of the average worker of that company. The legislature also introduced a second bill (2019 WA SB 6017) that would have imposed an excise tax on annual compensation in excess of $1 million, with a tax rate between 5% and 10% depending on the compensation amount.

- Other lawmakers in California, Connecticut, Illinois, Massachusetts, Minnesota, New York, and Rhode Island have also introduced similar bills. The Institute for Policy Studies has an online guide that includes a list of federal, state, and local legislative proposals related to CEO-worker pay ratios, along with general resources.[xlvii]

RAISING PROGRESSIVE MUNICIPAL REVENUE