Key Trends

States have:

- Prevented short-term displacement through eviction and foreclosure moratoriums

- Replaced lost income for those affected by COVID-19 with rental and mortgage assistance

- Stopped long-term evictions through rent freezes, cancellation, and suspensions

- Provided funding for shelters and homelessness services

- Continued the fight for comprehensive tenant protections, such as rent control and just-cause eviction

Introduction

The COVID-19 pandemic has heightened the existing racial and economic inequalities in the United States and created a deadly situation in which working-class families, already struggling to pay for the necessities of life, have been forced to stay at home while experiencing major losses in income and employment. In under six months, over 60 million workers in the United States filed for unemployment, and unemployment rates have skyrocketed to as high as 14.7 percent—almost five points higher than the peak of the Great Recession. This has led to immense housing insecurity for working-class renters and homeowners across the country.

In the wake of the Great Recession, millions of Americans became housing insecure, and many, particularly renters, never recovered. In 2019, 31.5 percent of all households were housing cost-burdened—meaning they pay more than 30 percent of their income toward housing and utilities. Almost half of renter households are cost-burdened. Additionally, the housing crisis has overwhelmingly impacted low-income families. Eighty-three percent of renters with incomes below $15,000 per year are cost-burdened, and 72 percent are extremely cost-burdened (paying over 50 percent of their income).

Meanwhile, the federal government has massively reduced its commitment to providing affordable housing for decades. Because of demolition and conversion, the public housing stock has been reduced by almost 500,000 units since 1996, and federal capital funding for public housing fell by over $2 billion per year from 2000 to 2013.

The Terner Center for Housing Innovation estimated that almost 16.5 million renter households have at least one worker who was employed in an industry affected by COVID-19-related job loss. With millions of Americans struggling to pay housing costs each month, the COVID-19 pandemic has exacerbated the housing crisis. Research suggests that about 31 percent of renters were unable to pay their rent on time in April, compared to 18 percent for the same time period in 2019.

Further, the housing crisis and pandemic have disproportionately affected Black, brown, and Indigenous communities. According to data released by New York City, COVID is killing Black and Latinx people at twice the rate it is killing white people. The economic impacts are also disproportionately felt by communities of color—the unemployment rate for Black workers peaked at almost 17 percent, while the unemployment rate for Hispanic women has reached over 20 percent. Black and brown families are disproportionately renters and employed in industries impacted by shutdowns and stay-at-home orders—the threat of COVID-19 to housing stability is an issue of racial justice. Further, homelessness disproportionately impacts communities of color. While Black people make up 13 percent of the United States population, they account for 40 percent of people experiencing homelessness, and Indigenous people similarly experience homelessness disproportionately.

A CDC order in September provided a national eviction moratorium to the end of 2020, but this moratorium is not self-executing and has not frozen all eviction filings. Housing advocates expect that when state and federal eviction moratoriums end and federal unemployment bonuses expire, many working-class renters will be threatened with eviction. Policymakers at the federal, state, and local level have taken action to try to keep millions of Americans housed during the pandemic. State lawmakers have introduced and enacted legislation that:

- places moratoriums on evictions and foreclosures;

- creates funds for tenant, landlord, and homeowner assistance;

- allocates funding for shelters and services for people experiencing homelessness; and

- cancels or suspends rental and mortgage payments.

This report summarizes some of the most important state-level developments from the 2020 legislative session. Please note that this is neither a comprehensive policy list nor necessarily a list of the most progressive solutions on this subject. When moving forward with legislation, we recommend working with state and national advocates to craft the best solution for your state. If you would like additional assistance or to be connected to your state or national advocacy groups, please email us at helpdesk@stateinnovation.org.

Eviction and Foreclosure Prevention

Many states have taken executive, legislative, and judicial action to prevent evictions and foreclosures during the pandemic. Governors have issued executive orders either limiting or fully prohibiting evictions and foreclosures during the pandemic (more info can be found on the details of the executive orders in the Other Resources section). State legislatures have taken further action to establish moratoriums on evictions and foreclosures past what has been outlined in executive actions.

Suspending Evictions and Foreclosures

The Massachusetts legislature passed MA H 4647, a 120-day eviction moratorium that allows the governor to extend the moratorium in increments of 90 days. Legislators failed to pass additional legislation (MA H 4878) that would have:

- Banned evictions for rent due for up to a year after the end of the COVID-19 emergency declaration.

- Implemented a just-cause eviction standard so tenants and foreclosed homeowners cannot be evicted for no-cause or non-renewal of lease for 12 months following the end of the emergency declaration.

- Frozen rents at the level they were at on March 10, 2020.

The Oregon legislature passed a bill (OR HB 4213) that extended the governor’s eviction moratorium until September 30. During the moratorium, landlords were prohibited from delivering notices of termination, taking possession of property or anything that would interfere with a tenant’s use of the dwelling, assessing late fees, or reporting a tenant’s nonpayment of rent to credit reporting agencies. The legislation also provides a six-month grace period following the end of the moratorium to pay the balance of unpaid rent.

New York legislators failed to pass a bill (NY S 8667/A 10827) that would have prohibited courts from executing an eviction warrant or order a monetary judgment for unpaid rent for all tenants for the duration of the state of emergency in New York, plus one full year past the emergency’s termination.

Alaska enacted legislation (AK SB 241) that suspended evictions for people experiencing financial hardship related to COVID-19 through June 30, 2020.

The California Assembly passed legislation (CA AB 828) that died in the Senate. It would have prevented any party from submitting a residential unlawful detainer complaint except to address issues of damage to the property, nuisance, or health and safety. It additionally would have prohibited a court from issuing a summons on a complaint for a residential unlawful detainer unless the court finds it is necessary for the reasons listed above. Finally, if a tenant provides documentation of economic hardship due to the COVID-19 pandemic, the bill would have allowed tenants up to 12 months, starting 90 days after the end of the state of emergency, to pay back unpaid rent from the COVID-19 emergency period.

The California Assembly has also passed a piece of legislation that failed in the Senate (CA AB 1436) that would have permanently protected tenants from being evicted for unpaid rent during the COVID-19 emergency and for 90 days after, or April 21, 2021—whichever date is earlier—and would have allowed tenants to pay back any unpaid rental debt accrued.

Another piece of California legislation (CA SB 915) that passed in the Senate and Assembly (but in different versions) would have provided eviction protections for manufactured housing and mobile home owners and tenants. The bill would have also prohibited mobile home park management from evicting or terminating the lease of an owner or tenant who is affected by COVID-19 for failure to pay rent.

Placing a Stay on Evictions and Foreclosures

Lawmakers have introduced legislation that would still allow landlords to file eviction notices with the courts, but would temporarily prohibit courts from carrying out the eviction order and removing a tenant from the property.

The New Jersey Senate passed a bill that is now in the Assembly (SB 2485) to prohibit evictions for nonpayment of rent during certain months surrounding the COVID-19 pandemic.

New York enacted legislation (NY S 8192B) to prohibit any court from issuing a warrant or judgment of possession against a residential tenant during the period of the COVID-19 declared state of emergency, specifically for nonpayment due to the pandemic, and to extend the state’s executive order on the evictions moratorium until the end of the declared state of emergency.

Vermont enacted legislation (VT S 333) that allows landlords and lenders to file new eviction and foreclosure actions, but requires the courts to stay the actions through 30 days past the end of the emergency period.

The Ohio legislature introduced legislation (OH HB 562/SB 297) that if passed would have prevented foreclosures and evictions during the COVID-19 state of emergency. Landlords would have still been able to file evictions in court, but the courts would have been prohibited from executing a writ of possession or removing the tenant from a residential property during the state of emergency. Notably, the legislation would have made it so a landlord would not be entitled to rental amounts that were unpaid during the state of emergency if the landlord filed a complaint during the state of emergency and received a writ of execution after the emergency terminated.

Enabling Local Government to Adopt Eviction Moratoriums

New Jersey legislators introduced a bill (NJ A 4228) that, as introduced, would allow local municipalities to adopt their own eviction prohibitions during the COVID-19 pandemic. If the legislation is enacted, it will retroactively cover missed payments for the covered period. (Note: companion bill NJ SB 2485 was amended by the Senate to place a stay on evictions—see above for more.)

Guaranteeing Forbearance

Introduced legislation (CA AB 2501) in California that did not pass would have allowed any borrower experiencing financial hardship during the state of emergency to request forbearance for any mortgage obligation. Mortgage servicers would have been required to grant forbearance for up to 180 days initially, after which the borrower could request up to another 180 days for up to 12 months in total.

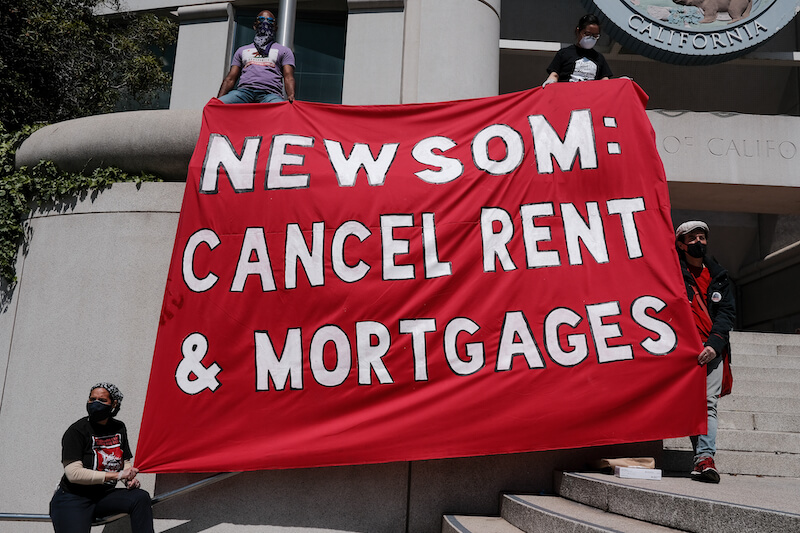

Rent Freeze, Suspension, and Cancellation

Housing advocates in several states have been pushing for more aggressive policy solutions than moratoriums to avoid a cascade of eviction filings and foreclosures once the moratoriums end. Instead, they are pushing for a rent freeze and the suspension or cancellation of rent and mortgage payments.

States can see examples from the efforts at both the federal level and local level. For example, Congresswoman Ilhan Omar introduced federal legislation (H.R.6515) to cancel rent and mortgage payments, in addition to any housing debt accrued during the pandemic, and New York City froze rents for one year for over 2 million rent-stabilized units.

- A rent freeze means that tenants still pay rent each month, but landlords are not able to increase rent at the end of a lease for the duration of the declared period.

- Rent suspension or cancellation means that tenants do not owe rent at all for the duration of the declared period.

Legislators in Massachusetts introduced a bill (MA H 4718) that would have implemented a rent freeze across the state for the duration, and 30 days following the end, of the declared state emergency. The bill would have suspended the statewide prohibition on rent control and the state's preemption of local rent control. It would have allowed the Department of Housing and Community Development and local governments to issue, maintain, and enforce a rent freeze and/or rent control for the declared period.

Terms

Rent Freeze: Tenants still pay rent each month, but landlords are not able to increase rent at the end of a lease for the duration of the declared period.

Rent suspension or cancellation: Tenants do not owe rent at all for the duration of the declared period.

New York lawmakers introduced a bill that failed (NY A 10247/S 8139) that would have partially suspended rent for tenants who had experienced a significant loss of income due to the government-imposed restrictions related to COVID. The legislation would have required those tenants to pay up to either 30 percent of their income or their contractual rent—whichever is less—per month for 90 days following enactment. Landlords also would have been able to apply for relief if they lost rental income.

Another New York bill (NY A 10224/S 8125) would have fully suspended rent payments for any residential tenant or small-business commercial tenant that had experienced a loss of income or forced closure of business due to the pandemic. The bill would have waived rental payments for covered tenants and small businesses for 90 days, and provided the automatic renewal of leases that expired during the covered period. A complementary bill (NY A 10255) was introduced that would have established an assistance fund for “small landlords.”

A stronger rent cancellation bill that was introduced, but failed, in New York (NY S 8802/A 10826) would have fully canceled rent for all tenants and canceled mortgages for small homeowners for the duration of the declared state disaster emergency and 90 days following it. The bill would have additionally provided funding to assist and reimburse housing cooperatives, affordable housing providers, public housing authorities, and landlords.

Illinois legislators introduced an amendment that did not pass (COVID-19 Emergency and Economic Recovery Renter and Homeowner Protection Act) that would have cancelled rent and suspended mortgage payments for those who contracted COVID-19 or experienced a loss of income. The legislation would also have provided protection from retaliation for nonpayment of rent or mortgage, set up a relief fund for landlords and mortgagees negatively impacted by missed payments, and implemented restrictions on evictions for the period following the end of the emergency period.

Lawmakers in New Jersey introduced legislation (NJ A 3948) that would have required a landlord to suspend rent for 90 days upon request from a residential tenant. After 90 days, the tenant would have been able to request another 90 days of rent suspension. Tenants would not be required to pay the balance of their unpaid rent during the period of the suspension.

Rent and Mortgage Assistance

While at the federal level, advocates have pushed for $100 billion in emergency rental relief, and many states have set up their own rental and mortgage assistance programs. As eviction moratoriums end, millions of renters across the country will require assistance in order to pay not only their current rent, but unpaid rent accrued during the moratorium periods.

Several state legislatures have appropriated CARES Act funds toward rental and mortgage relief, while governors in multiple states, such as Minnesota, Michigan, and Washington, have also taken action to distribute funding toward assistance programs. While still impactful, advocates have raised concerns that current rental relief efforts will fail to meet the level of support necessary, especially without further federal support. For example, the city of Houston exhausted a $15 million rental fund in 90 minutes, and the city of Los Angeles’s $100 million fund only covered 14% of renters at risk of eviction.

Direct Assistance to Tenants or Landlords

Pennsylvania, Illinois, and Colorado enacted legislation (PA HB 2510, IL SB 264 sections 20 and 21, and CO SB 20-1410) establishing rental and mortgage assistance funds. Colorado appropriated $19.65 million to the program, while Pennsylvania allocated $150 million, and Illinois allocated $396 million. The Pennsylvania legislation provides assistance to renters and homeowners who either became unemployed or whose annual household income is reduced by 30 percent or more. The fund provides grants to homeowners and renters and covers 100 percent of their rent or mortgage—up to $750/month for renters and $1,000 for homeowners for a maximum of six months. The Illinois legislation reserves $100 million for areas disproportionately impacted by the pandemic. Utah enacted similar legislation (UT SB 3006), which established a fund of $20 million for residential housing assistance and $40 million for commercial rental assistance.

While the New Jersey legislature originally passed legislation (NJ S 2332) to establish a rental relief program, the bill was vetoed by Governor Phil Murphy. Instead, he created a program through executive action, and appropriated at least $100 million to rental assistance. Twenty percent of the program's funding is devoted to people with very low income who are homeless or at risk of homelessness and provides them with up to 12 months of rental assistance. The rest of the funding will be distributed on a lottery basis to households that earn below 80% of the area median income (AMI), were current on rental payments before March 1, 2020, and are able to prove they have been significantly impacted by COVID-19 through either layoffs, reduced work hours, or forced unpaid leave for childcare.

Legislators in New York (NY S 8419) enacted a bill that establishes a rental assistance fund of $100 million to provide aid to households that earn up to 80% of the area median income, had a rent burden both on March 1, 2020, and at the time of their application for assistance, and have experienced a loss of income during the coverage period. The program would cover the difference between a household rent burden (the amount of rent owed that is more than 30% of a tenant’s income) on March 1, 2020, and their rent burden at the time of their application for assistance.

Deferment of Rent

A bill backed by the landlord lobby in California (CA SB 1410), which passed the Senate but died in the Assembly, would have allowed landlords and tenants to enter into a “COVID eviction relief agreement.” In an agreement, the tenant could defer his or her rent for the entirety of the state of emergency and for an unspecified number of additional days following the state of emergency’s conclusion. The state would assume the debt burden, and provide the tenant until 2034 to repay the unpaid rent, or apply for loan forgiveness. In exchange, the landlord would receive ten years of tax credits equal to the unpaid amount and would have the opportunity to sell tax credits to investors. Landlords who enter into an agreement would be prohibited from taking an eviction action against the tenant during the state of emergency period.

Utility Assistance

Another bill in Colorado was enacted (CO HB 20-1412) that appropriated $4.8 million of funding from the CARES Act to provide direct utility bill payment assistance to low-income households facing economic hardship due to the pandemic.

Homelessness

Individuals and families experiencing or at risk of experiencing homelessness have a disproportionate risk of getting COVID-19. Without shelter, it is immensely difficult to self-isolate and take proper preventative measures like handwashing. According to the National Low Income Housing Coalition, people who are experiencing homelessness and contract COVID-19 are twice as likely to be hospitalized and two to three times more likely to die from the virus than the general public.

States have allocated money, often from CARES Act funds, to homeless shelters and assistance, and the legislative examples below are from states that allocated money in their budgets to homelessness directly in response to the pandemic. Please note that this is not inclusive of all legislation related to homelessness outside of the pandemic. Additionally, some of the above legislation establishing rental and mortgage assistance programs contains language that prioritizes distribution of funds to families at risk of homelessness.

Legislators in Alaska enacted legislation (AK SB 241) to provide financial assistance on a statewide, regional, or community basis as necessary to address or prevent homelessness caused by the pandemic.

The Pennsylvania legislature enacted a bill (PA HB 2510) that allocated $10 million for services for homeless residents. Similarly, lawmakers in Utah appropriated (UT HB 4001) $4.67 million from the CARES Act to the state’s Homelessness committee. Minnesota lawmakers passed legislation (MN HF 4531) that provides $15.2 million for additional shelter space and purchasing vouchers for motel and hotel rooms in order to allow homeless individuals to effectively shelter in place.

Broader Tenant Protections

2019 saw monumental movement for comprehensive tenant protections. Oregon became the first state in the nation to pass a statewide rent control bill, with California and New York adopting their own statewide legislation soon after. While the pandemic sidelined efforts to pass similar legislation in other states, several rent control and eviction protections bills were introduced across the country. Lawmakers in California and New York also introduced several pieces of legislation to strengthen their existing laws.

Repeal of Rent Control Preemption Laws

Legislators in at least four states introduced legislation that would repeal state bans on rent control legislation.

The Massachusetts legislature considered a bill (MA H 3924) that would have removed the state’s preemption of municipal rent control policies. The bill would have affirmatively allowed for the regulation of rents for multi-family housing and manufactured housing, condominium conversions, and no-cause evictions.

Lawmakers in Illinois introduced legislation (IL HB 255) that would have repealed the state’s 1997 Rent Control Preemption Act, which bans local units of government from controlling residential and commercial rents.

Similar efforts were introduced in Utah (UT HB 131) and Florida (FL HB 6013/SB 910).

New Rent Control Legislation

While several municipalities in New Jersey have implemented rent control, lawmakers introduced a statewide rent cap bill that did not pass (NJ A 1923). The bill would have established a cap on annual rent increases of 5 percent plus the percentage change in cost of living, or 10 percent—whichever was lower.

Legislators in Illinois (IL SB 3771) also introduced a bill that would have established statewide rent control and implemented a just-cause eviction protection for renters. The bill would have limited rent increases each year to 5 percent plus the change in cost of living, or 10 percent, whichever was lower, and limited legal evictions to nonpayment of rent and material breaches of a lease.

Strengthening Existing Legislation

New York legislators introduced several pieces of legislation to enhance tenant protections passed in 2019, in one of the boldest legislative efforts to protect renters in the nation. These bills included a just-cause eviction law (NY S 2892/A 5030), an expansion of the 2019 rent stabilization law (NY S 5040/A 7046), an end to landlord-friendly loopholes such as vacancy decontrol (NY S 2591/A 1198) and vacancy bonuses (NY S 185/A 2351), an end to permanent rent increases for capital improvements (NY S 3693/A 6322), and making preferential rents permanent (NY S 2845A/A 4349).

A recently enacted bill (CA SB 1190) in California would have strengthened enforcement mechanisms for the Tenants Protection Act of 2019. The bill would have directed city attorneys, district attorneys, or county counsel to prosecute violations of the legislation’s rent cap and just-cause eviction provisions, including awarding restitution and levying fines up to $20,000. However, this provision was stripped via amendment, and the bill as enacted focuses on the right of tenants to terminate tenancy based on a family member being a victim of a crime.

A ballot measure that failed in California (Rental Affordability Act) would have expanded the state’s rent control laws. If passed, the measure would have reformed major sections of the Costa-Hawkins Act. The ballot measure would have extended the state’s rent regulations to all buildings over 15 years old, allowed for rent control on single-family homes when an owner owns more than two homes, and enacted limitations on rent increases after a tenant vacates a unit.

Rent Control for Manufactured Housing

Michigan lawmakers introduced a bill (MI HB 5569) that would have exempted manufactured housing parks from the state’s rent control ban. It would also created a rent cap only applicable to manufactured housing parks equivalent to the most recent annual change in the Consumer Price Index.

Three pieces of legislation were introduced in California (CA SB 999, AB 2895, AB 2690) that would have expanded rent regulations to manufactured housing. SB 999, which passed out of the Senate but died in the Assembly, would have required new manufactured housing leases to be covered by local rent control ordinances. AB 2690, which passed out of the Assembly but died in the Senate, would have repealed exemptions for manufactured housing from local rent regulation. AB 2895, which also passed out of the Assembly and died in the Senate, would have applied the same rent cap and eviction protections under the Tenants Protection Act to manufactured housing starting in 2021.

Looking Forward

Over the past few years, housing justice advocates have increasingly pushed for reinvestment and construction of publicly owned housing in the United States. In 2019, Homes Guarantee launched an effort to guarantee the right to safe and affordable housing with a plan to build 12 million social housing units across the country, reinvesting in existing public housing, protecting renters and bank tenants, paying reparations for centuries of racist housing policies, and ending land and real estate speculation.

On the federal level, Rep. Ilhan Omar has introduced the Homes for All Act (H.R.5244) to repeal the Faircloth Amendment, which prohibits the construction of new public housing units, and invest $1 trillion to construct 8.5 million publicly owned units and 3.5 million units of privately owned, local, permanently affordable housing.

This year, lawmakers in Maryland introduced groundbreaking legislation (MD HB 1149) that would have funded the creation of a new state social housing program in order to construct an estimated 2,000 units of permanently affordable, government-owned, mixed-income housing. While the legislation failed, it presented one of the first pieces of legislation to construct social housing at the state level.

Additional Resources

- Eviction Lab: COVID-19 Housing Policy Scorecard

- Anti-Eviction Mapping Project: COVID-19 Housing Protection Legislation

- Homes Guarantee: COVID-19 Response

- Homes Guarantee: A National Homes Guarantee Briefing Book

- NLIHC: CARES Act Suggestions for State, Local, Tribal, and Territorial Elected Officials

- NLIHC: COVID-19 and Homelessness

- National Alliance to End Homelessness: The Framework for an Equitable COVID-19 Homelessness Response

- National Homeless Law Center: COVID-19 Protections for Homeless Populations

- PolicyLink: Centering Racial Equity in Housing

- National Housing Law Project: Protecting Renter and Homeowner Rights During Our National Health Crisis

- National Housing Law Project: Model Eviction Moratorium Act