How States Can Stop the Corporate Campaign To Roll Back Child Labor Protections

How States Can Stop the Corporate Campaign To Roll Back Child Labor Protections

Executive Summary

The enactment of the Fair Labor Standards Act (FLSA) in 1938 marked the passage of the first federal standards for child labor in the U.S., prohibiting the long hours, dangerous jobs, and abusive practices that many children suffered at the time. Now, nearly nine decades later, state legislatures, spurred by political operatives working on behalf of deep-pocketed corporate interests, are the epicenters of a national campaign to turn the clock back on child labor protections.

Since 2021, at least 61 bills to roll back child labor protections have been introduced in 29 states, and at least 17 bills have been enacted in 13 states. The proposals, some of which would directly conflict with federal standards, include provisions that would repeal work permit requirements, extend work hours, legalize employment in hazardous occupations, allow children to be paid less than the state minimum wage, lower the minimum age for alcohol service, and preempt the passage of stricter child labor protections at the local level. Without adequate federal or state enforcement capacity, the recent onslaught of legislative activity to bring back 19th-century child labor standards promises to intensify a growing national crisis of child labor violations, especially among migrant youth.

State lawmakers and advocates have the power to organize and push back against these coordinated attacks and to put forward a different vision for the future where labor policies safeguard the safety, well-being, and education of children. This publication is intended to serve as a resource to legislators and state advocates in resisting efforts to deregulate child labor protections. It offers policy options that can strengthen labor protections for young workers. A stronger framework for child labor standards at the state level should consider the following:

- Enhancing child labor protections. States can and should establish labor protections that go above and beyond federal standards for young workers. Examples include time and hour restrictions for 16- and 17-year-olds, prohibitions on hazardous occupations, rest or meal break requirements, work permit requirements, repealing youth subminimum wage laws, and strengthening protections for children in agricultural work.

- Enhancing enforcement and penalties. States should adopt an enforcement strategy that maintains a credible ability to enforce against violations and includes a penalty regime that provides effective deterrence.

- State lawmakers can establish strong civil and criminal penalties, including minimum penalties and damages payable to workers, in addition to enhanced penalties for egregious violations.

- Legislators can also enhance enforcement by establishing anti-retaliation protections, extending the statute of limitations on violations, expanding agency enforcement powers, and boosting enforcement capacity, particularly by adding language and cultural capacity to appropriately support migrant children.

- State legislators can consider strategies that support enforcement on behalf of the state, like community enforcement programs, private attorneys general laws that authorize aggrieved employees to bring enforcement actions on behalf of the state, or dedicated grant funding to local prosecutors to support labor enforcement actions.

- Lawmakers can ensure that children have appropriate legal remedies when they are harmed by child labor violations by ensuring that injured or killed workers are not limited to workers’ compensation as an exclusive remedy and by establishing a private right of action.

- Extend liability to all entities that profit from child labor. State lawmakers should modernize child labor protections to account for 21st-century business structures that often allow the most powerful entities to evade accountability. Examples include laws that hold lead corporations responsible for violations committed within their supply chains and laws that establish joint liability for franchisors and franchisees.

- Establish public procurement compliance requirements. States can set a standard for strict compliance with child labor protections through the procurement process by requiring contractors to disclose child labor violations and maintaining compliance with child labor protections as a condition for eligibility for public contracts.

- Support education, outreach, and service coordination efforts. Legislators can also enable improved enforcement outcomes by supporting education and outreach efforts that ensure that children and their families are adequately informed of their rights under the law and by facilitating coordination among labor officials, public education systems, social services, and immigrant legal services to ensure that investigations of violations do not leave families without access to material and legal support.

The scheme to deregulate child labor state by state is inseparable from attacks on workers’ rights, safety net programs that help families get back on their feet during hard times, the right to an honest and quality education, a fair tax system where wealthy corporations pay what they owe, and our freedom to vote and our right to fair representation. Altogether, these conjoined efforts—driven by insatiable corporate greed and bolstered by outsized elite influence over our democracy—paint a bleak future of an endless race to the bottom for cheap labor, enshrined by the exploitation of children at the expense of their health, safety, and education.

Introduction

In recent years, state legislatures have been the focus of a national operation to repeal laws that protect young people’s health, safety, and educational rights. The campaign to drag labor protections back in time to the 19th century is part of a sweeping, multi-issue effort to further concentrate corporate power, undermine worker rights, and dismantle government regulation, all while cementing wealth inequality by stratifying access to public education and tearing down anti-poverty programs. Since 2021, at least 61 bills to weaken child labor protections have been introduced across 29 states, including 17 bills that have been enacted in 13 states.

The ultimate intent of the corporate lobby is clear: to pave a path to national deregulation of child labor, one state at a time. State lawmakers have the power to put a stop to the plot to build an economy that allows businesses to profit on the backs of children, even in the most dangerous jobs. This publication is intended to serve as a resource to legislators and advocates in responding to the ongoing efforts in state capitols to deregulate child labor. In addition to examining the industry-backed actors behind the corporate conspiracy to roll back child labor protections, the publication outlines the types of regressive legislation that states have considered and passed in recent years and offers potential policy options that legislators may consider to further strengthen state protections for young workers.

History Repeats Itself: A Look Behind the Curtain of the Campaign To Roll Back Child Labor Protections

In the years following the proposal of a constitutional amendment authorizing Congress to regulate child labor in 1924, a new organization called the Farmers’ States Rights League (FSRL) distributed over a quarter-million pieces of literature opposing the amendment, spreading false claims that children would be prevented from doing chores around the home and family farm. The propaganda spread through half-page advertisements in small-town newspapers, leaving readers with the misguided impression that the campaign was funded organically by a group of farmers who came together in opposition to the amendment.

In reality, the FSRL was operated by David Clark, a frontman for wealthy Southern textile factory bosses—an industry that thrived on child labor—to create the facade of public resistance to the amendment in rural America. Clark, a virulent white supremacist who frequently railed against integration as the publisher of the influential Southern Textile Bulletin, was also the mastermind behind a litigation strategy to stonewall new child labor protections. His efforts, which included selecting a friendly federal judge and cajoling young cotton mill workers to serve as plaintiffs in lawsuits he paid for, resulted in the U.S. Supreme Court striking down two newly enacted federal child labor protections. One of the plaintiffs handpicked by Clark, when interviewed by a reporter years later, reflected: “I’d been a lot better off if they hadn’t won it. Look at me! A hundred and five pounds, a grown man and no education.”

While the proposed amendment was never ratified, Congress eventually enacted the Fair Labor Standards Act (FLSA) in 1938, prohibiting children from being employed in certain types of hazardous work, establishing a minimum age of 16 for most types of work, and limiting the number of hours and the time of day that children are allowed to work to protect school attendance. Nearly a century later, a different set of actors, funded by the newest generation of billionaire industrialist barons, are playing the same cast of characters in another astroturfing production to fabricate the illusion of widespread support for policies that only serve to line the pockets of the wealthy through increasingly dangerous child labor.

Industry Fronts: Agribusiness, the Foundation for Government Accountability, and the Opportunity Solutions Project

Agricultural industry groups continue to be outspoken proponents of weakening child labor protections. In the same model as the FSRL, they point to these protections as being burdensome for family farmers when, in truth, these groups represent multinational agribusiness corporations. Groups opposing a proposed federal rule to increase child protections in the FLSA in 2011, for example, included some of the biggest actors in the industry, such as pesticide trade group CropLife America, the National Cotton Council, and the American Farm Bureau Federation (AFBF). The AFBF, in particular, was founded in 1919 as a contemporary of the FSRL but has remained a powerful lobby group in the century since—calling itself “the voice of agriculture” while representing large agribusiness interests. In addition to advocating for weaker child labor protections, the AFBF supported the repeal of both the Voting Rights Act of 1965 and the Affordable Care Act while consistently pressing for policies that harm the independent family farmers it claims to represent.

Other proponents of child labor rollbacks in statehouses across the country reflect a similar array of lobbyists and trade associations for other businesses and industries that stand to benefit most from child labor, including the restaurant, hospitality, and retail industries. During a hearing on a bill to repeal work permits in Arkansas, the legislative sponsor acknowledged that the legislation came from a Florida-based organization called the Foundation for Government Accountability (FGA). At the same time, emails obtained by reporters revealed that similar bills were sent by FGA lobbyists to Florida and Missouri lawmakers.

Before the organization turned its attention to making it easier for businesses to exploit child labor in recent years, the FGA spent over a decade parachuting into statehouses on behalf of corporate interests—in the past seven years, the FGA and its advocacy arm, the Opportunity Solutions Project (OSP), have deployed 130 lobbyists into 29 state capitols. The group’s parallel efforts to gut public assistance programs (which primarily serve children experiencing poverty and their families), push the long-discredited idea of work requirements for safety net eligibility, and weaken state unemployment benefits illustrate a clear agenda: to ensure that low-wage workers are forced to accept poverty wages or abusive working conditions. More recently, to dilute the political power of voters and lock states in minority rule, the FGA has also waged attacks on our freedom to vote and direct democracy.

Reflecting on its work during the 2021 legislative session in states across the country, the FGA boasted in its annual report that thanks to the expansion of its “Super State strategy, which involves doubling down in key states to drive national change with big reforms,” Arkansas legislators enacted 48 “FGA reforms,” while Florida had implemented 26 of the organization’s solutions. Just two years later, lawmakers in Arkansas and Florida, in addition to two of the newest FGA Super States, Iowa and Wisconsin, passed bills to weaken child labor protections.

The FGA and OSP are funded by a number of ultra-wealthy industrialists who have funneled billions into a vast network of organizations to do the bidding of large corporations and conservative extremists. Some known funders of the FGA and OSP are also behind other industry investments to capture judicial and legislative power:

- Leonard Leo, through the 85 Fund (formerly known as the Judicial Education Project), is best known as the architect of the Federalist Society’s multi-decade project to pipeline conservative jurists from law school to federal judgeships as high as the U.S. Supreme Court, with the goal of building, from the bottom up, a judicial branch friendly to corporations and conservative extremists. Leo, who recently took control of a new conservative advocacy organization that received a record-breaking $1.6 billion donation, is also known for brokering intimate face time between Supreme Court justices and wealthy donors—with millions in financial interest in cases pending before the court—during lavish fishing trips and exclusive donor retreats.

- David and Charles Koch, through DonorsTrust, are the billionaire oil tycoons behind two state-based networks, Americans for Prosperity (AFP) and State Policy Network (SPN), that provide the appearance of local support for policies generated by some of the country’s largest corporations. Together, AFP and SPN have worked in tandem with the American Legislative Exchange Council (ALEC) to drive an extremist agenda in states that enables the elite to amass even more wealth by evading their fair share of taxes, privatizing critical government institutions, exploiting workers and destroying their right to form a union, shredding the social safety net, pushing hardline immigration policies that drive a permanent underclass of workers into a shadow economy, and allowing for unfettered extraction of natural resources. In addition to driving a corporate agenda in statehouses, Koch-funded organizations have also led efforts to maintain indefinite control of state legislatures through voter suppression and partisan gerrymandering strategies.

The similarities between the tactics of modern pro-child labor groups and their forebears are striking: front organizations are financed by a wealthy network of elites to create the pretense of citizen-driven campaigns for policies that make benefactors even more profitable in their industries. When paired with the ongoing crusade to push our democracy, state by state, into crisis, policies designed to enact economic oppression on the most vulnerable workers promise to ensure that the power to hoard wealth and opportunity remains a feature of our nation’s laws for generations to come.

Federal and State Enforcement Capacity is Insufficient Amidst Increased Violations and Conflicting State Laws

The Supremacy Clause of the Constitution provides that federal law takes supremacy over conflicting state laws. While states may enact laws that provide legal protections above federal law, they may not lower the “floor” set by federal law. State legislatures have a long tradition of establishing and enforcing higher labor standards for their residents, including establishing some of the country’s first child labor protections a century before the passage of the FLSA.

States that roll back state child labor standards are actively diminishing their important, long-standing roles in enforcing child labor protections, leaving more and more of the enforcement burden to an already short-staffed federal Department of Labor (DOL) at a time when employer violations are sharply increasing. Weakening state standards signals to unscrupulous employers that child labor violations are less likely than ever to be investigated in a certain state while creating new confusion, even for well-intentioned employers, about what is and is not legal, increasing the likelihood of additional violations.

During the 2023 legislative session, federal DOL officials responded to a request from Iowa lawmakers regarding a bill (2023 IA SF 542), which has since been enacted into law, to confirm that several provisions were inconsistent with federal law. The DOL more recently alerted employers that they remain legally obligated to comply with federal child labor protections rather than newly enacted and weaker state laws, reminding employers that “[w]here a state child labor law is less restrictive than the federal law, the federal law applies. Where a state child labor law is more restrictive than the federal law, the state law applies.”

Despite the legal impotence of some provisions contained in new state child labor laws, they are deliberately intended to introduce confusion to the existing regulatory framework, take advantage of a vastly under-resourced and understaffed federal labor enforcement agency, and heighten conflicts between state and federal standards to build a case for lowering standards nationwide. The ultimate goal, as the FGA outlined in a recent report, is to “open the door to federal regulatory reform” by getting “enough states to successfully implement a reform.”

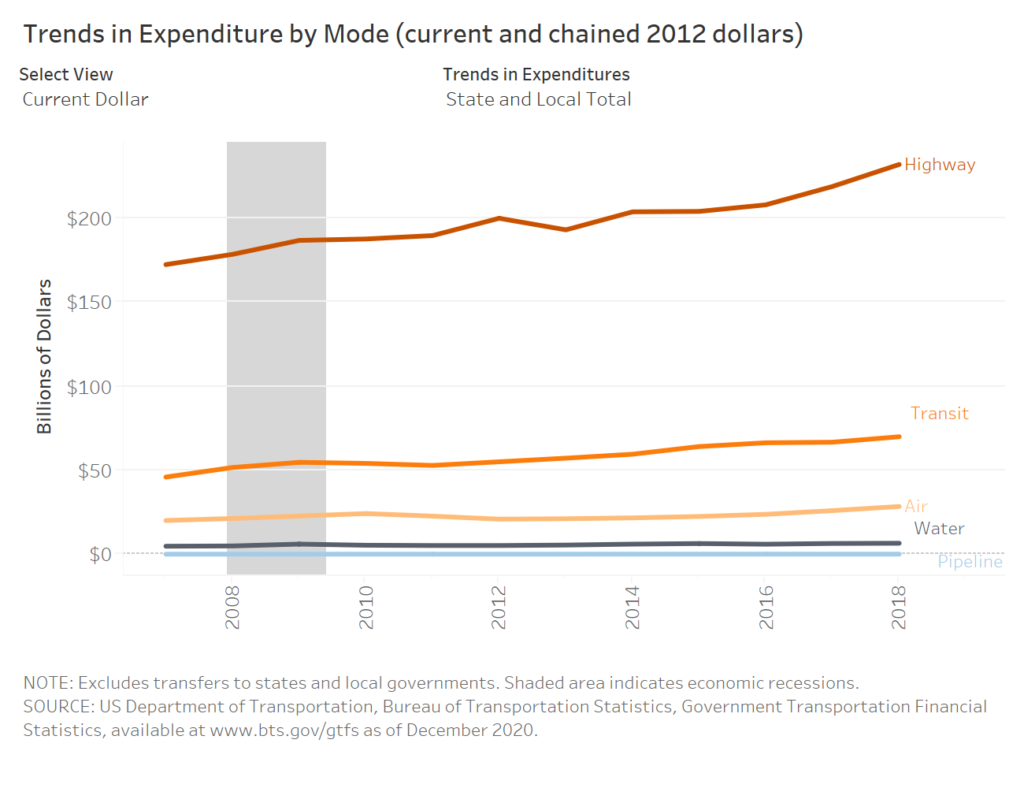

In response to an 88% increase in child labor violations since 2019, federal officials have announced new enhanced enforcement efforts and provided additional guidance to local Wage and Hour Division (WHD) offices to ensure full utilization of the agency’s enforcement authority. Still, the WHD recently reported that it lost 12% of its staff between 2010 and 2019 due to its funding remaining flat. In 2019, WHD investigators were responsible for twice as many workers as they were four decades ago, while compliance officers with the Occupational Safety and Health Administration (OSHA) were responsible for three times as many workers over the same time period.

The Realities of the Child Labor Catastrophe

Proponents of weakening child labor protections frequently trot out feel-good stories suggesting that the rollbacks will open opportunities for teenagers working at the local movie theater or grocery store to save up for a prom dress when, in reality, these types of jobs are already fully legal options for teens as young as 14 in all states. Deregulation is instead aimed at stripping long-standing safety and scheduling standards that protect the health and education of children. Removing these guardrails will have the most dire, life-threatening consequences for children who are working to survive in some of the most dangerous and hidden jobs in our economy. This is made all the more urgent by a recent increase in unaccompanied migrant children driven from their home countries by economic desperation. State legislatures are the most important stopgap today for preventing the continued abuse, serious injury, and death of children in the workplace.

Compounded by violence and the disastrous effects of climate change, the economic fallout from the pandemic pushed many in Central America into a severe economic crisis. Many families facing extreme hunger and poverty had little choice but to send their children to the U.S. through a narrow opening in an otherwise broken immigration system that, until recently, closed the southern border to unauthorized arrivals and asylum seekers, except for children.

Nearly 350,000 unaccompanied children were released by federal officials in a three-year period between 2020 and 2023—almost a 180% increase from the previous three years. Whereas the majority of unaccompanied minors in years past were primarily released to parents already living in the country, today, only one-third are sponsored by parents, with the remainder being sent to relatives, acquaintances, or strangers. Unaccompanied children are held temporarily at shelters under the care of the U.S. Department of Health and Human Services (HHS) while caseworkers vet sponsors to identify red flags for potential trafficking, such as sponsors that have claimed responsibility for dozens of unrelated children.

About one-third of unaccompanied children who are identified as high-risk continue to receive case management services after release. In most instances, children are released to sponsors with the number of a national hotline and receive a phone call from federal officials within a month of release. In 2022, HHS reported not being able to contact one-third of minors in the month after their release to sponsors, while trafficking reports to the national hotline have increased by 1,300% in just five years.

Child Labor Violations Are Widespread and Largely Unchecked

The stories gathered from interviews with migrant children themselves, as well as the caseworkers, teachers, and community members around them, all bear strikingly repetitive refrains. Upon arriving in the country alone and without work permits, unaccompanied migrant children, often saddled with debt from their journey and with the obligation to support families back home, inevitably end up filling some of the most undesirable jobs that are often outsourced and persistently vacant due to the refusal of corporations to pay fair wages. These children frequently end up dropping out of school or never enrolling at all.

Though federal law prohibits children from being employed in many of these roles, employers frequently look the other way, as was in the case of a 13-year-old worker who presented documents that identified them as a 30-year-old. Even when multimillion-dollar corporations are caught in a federal investigation, the maximum civil penalty for child labor violations—less than 1% of the penalty for insider trading—is trivial to those corporations when balanced against the profits generated by ignoring labor protections. Some of the most egregious violations have been at worksites that are within the supply chain of major household brands like Tyson, Hyundai, and General Mills, which are insulated from liability by layers of subcontractors and third-party agencies.

Over and over, reporters and federal investigators have laid bare the widespread nature of child labor violations in today’s economy. Each story below, alongside many more, shares similar themes of exploitation and willful ignorance by employers, who often face little to no accountability, even in cases involving serious injury or death:

- In rural Virginia, a 14-year-old who would finish his overnight shift in a Perdue chicken slaughterhouse 20 minutes before getting on the bus to school was maimed when a conveyor belt caught his arm. Without full function restored to his arm, which still requires at least three additional surgeries, he has no choice but to focus on school—a rare opportunity for unaccompanied migrant children—even as interest accrues on the debt that his family took on to send him to his adult cousin in Virginia. When notified of the maiming incident, OSHA officials handed the investigation to officials in Virginia, who permitted the company to complete a “self-inspection,” resulting in no citations for the company and no reference to the worker’s age.

- Reporters recently interviewed more than 100 child roofers working in nearly two dozen states, painting a bleak picture of an industry that relies on children as young as 10 to fill a workforce shortage. The stories are nauseating: a 15-year-old who fell to his death in Alabama with a crew of nine people and only six harnesses; a 15-year-old in Florida who slipped and burned his body when he fell into a vat of tar; a 17-year-old in Louisiana who was electrocuted to death while operating a forklift for the first time; and Antoni, a 15-year-old who fell 30 feet onto concrete from the roof of a South Carolina beach house. The sheer asymmetry between the deadly risks that children take on and the consequences that their employers face is breathtaking—of the three deaths referenced in the article, none has resulted in any child labor fines. As for Antoni, who woke up from a three-month coma and was unable to access rehabilitation services to address memory loss and mobility issues without health insurance, three tiers of roofing contractors each contend the other is liable for workers’ compensation, and only one has been fined $500 by state labor investigators.

- A 2022 DOL investigation found at least seven underage workers, including two brothers aged 13 and 15, illegally employed by a Hyundai manufacturer in Alabama through a third-party staffing agency. The brothers, who were also living in a house owned by the president of the staffing agency, reported that one of the intermediaries that recruited them also led them to believe that the entity had the power to deport them. The manufacturer was fined just $30,000; Hyundai was shielded from legal liability by a complex web of suppliers and staffing agencies and is set to receive $2.1 billion in state and local tax breaks and incentives in Georgia.

- A massive federal DOL investigation found at least 102 teens working in violation of federal law across 13 facilities in eight states for Packers Sanitation Services Inc. (PSSI), a contractor that describes itself as the leading sanitation company for meatpacking plants. The investigators estimated there were at least five times as many children employed illegally based on observations. According to court records, the children handled high-pressure hoses, scalding water, industrial solutions that caused chemical burns, and power-driven machines like 190-pound saws. Meanwhile, PSSI, which is owned by Blackstone, the world’s largest private equity firm controlling over $1 trillion in wealth, paid a $1.5 million civil fine, or 1% of the company’s cash on hand, and faces no criminal charges.

- At one Southern California poultry plant, federal investigators found children as young as 14 deboning chickens and operating forklifts outside of allowable work hours. The investigation also revealed that the processor, which supplies poultry to brands like SYSCO Corp. and Kroger, committed wage theft violations by paying workers less than minimum wage and refusing to pay overtime wages while retaliating against workers who cooperated with the investigation. In total, the poultry processor was ordered to pay $3.5 million in back wages and damages to workers, in addition to over $201,000 in civil penalties. The owner of the plant was recently the subject of an investigation by state labor officials that resulted in a $1.47 million settlement, including over $900,000 in wages stolen from 300 workers.

- Federal regulators at the WHD announced an investigation of three McDonald’s franchisees that identified 305 children working in violation of child labor laws—including two 10-year-olds who worked as late as 2 a.m. at a Louisville restaurant. In total, the franchisees were assessed over $212,000 in civil penalties for violations and recovered nearly $15,000 in back wages and damages from one franchisee who failed to pay overtime wages. Since 2021, McDonald’s franchisees have been assessed over $577,000 in civil penalties for violations involving 825 minors. Franchise agreements with brands like McDonald’s are often vague when it comes to compliance with labor laws, to limit the brand’s liability exposure.

- A recent OSHA investigation concluded that Mar-Jac Poultry, a Mississippi poultry processing plant, “disregarded safety standards,” resulting in a fatal incident where a 16-year-old was pulled into a machine that he was sanitizing in July of 2023—an occupation prohibited under federal child labor laws. Mar-Jac Poultry was cited with 17 safety violations and fined $212,646; the company is still in the process of contesting a penalty of $27,306 from another fatal incident in 2021. A nonprofit that owns a three-quarters stake in the parent company of the poultry processor, Mar-Jac Holdings, recently reported that its ownership stake in the holding company was equal to over $235 million in assets in 2022.

On its own, the idea of allowing children to work full-time or on graveyard shifts while attending school, to operate dangerous industrial equipment sharp enough to butcher cattle, to work in a bar at the age of 14, to toil in fields while inhaling toxic pesticides at 12, or to handle caustic cleaning solutions while wearing protective gear several sizes too large for less than minimum wage and without oversight is shocking and dangerous. But when taken together with the other priorities of the shadowy network of industry-funded groups that have cloaked their campaign to deregulate child labor as simply a matter of cutting “red tape,” the effort presents an existential threat to the future that most of us envision for our children.

Given the improbability of federal action on child labor, even in the face of rising violations, new conflicting state laws, and lack of federal enforcement capacity, state lawmakers have a central role to play in protecting the health and safety of children in the workplace. In addition to fighting back against continued child labor rollbacks, legislators can strengthen child labor standards and boost enforcement capacity at the state level.

The Campaign To Weaken Child Labor Protections

Since 2021, at least 61 bills to weaken child labor protections have been introduced across 29 states:

- 17 bills were enacted in 13 states—Alabama, Arkansas, Illinois, Iowa, Kentucky, Michigan, New Hampshire, New Jersey, New Mexico, North Carolina, Ohio, Tennessee, and West Virginia. Two additional bills were enacted in Michigan and Wisconsin but were vetoed by the governor in each state.

- 29 bills (and counting) are currently pending in 19 states—Alabama, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kentucky, Massachusetts, Minnesota, Missouri, Nebraska, New Hampshire, New Jersey, New York, Ohio, Oklahoma, Pennsylvania, and Wisconsin.

Recent legislation to weaken protections for children in the workforce has generally included some combination of the following provisions.

- Eliminating employment certification requirements. In most states, minors of certain ages must be issued work certificates, sometimes referred to as work permits, in order to be employed. Employment certificates, issued by either state labor officials or school officials, typically document the minor’s work and proposed schedule, affirm parental consent, and verify the child’s age. Many recent bills include proposals to eliminate work permits, bypassing parents while also eliminating documentation that can be used in investigations of potential violations and that serves as notice to children, families, and employers of state child labor laws.

- Extending work hours. Federal law limits the times of day and number of hours that 14- and 15-year-olds may work: outside of school hours, no more than 3 hours on a school day, no more than 8 hours on a non-school day, no more than 18 hours during a week when school is in session, no more than 40 hours during a week when school is not in session, and between 7 a.m. and 7 p.m. (or 7 a.m. to 9 p.m. between June 1 and Labor Day). Some states additionally have more restrictive limits on the number of hours or times of day that children are allowed to work, including guidelines for the employment of 16- and 17-year-olds enrolled in school. Several states are contemplating changes to their laws that would increase the number of hours that children are permitted to work on a daily or weekly basis or allow children to work later on school nights—even in violation of federal law, in the case of at least one bill (2023 IA SF 542) passed in Iowa.

- Expanding types of permissible hazardous employment. Under federal law, the Secretary of Labor is authorized to identify jobs that 14- and 15-year-olds are permitted to do. Any job not expressly identified by the Secretary of Labor is prohibited, and the Secretary of Labor additionally identifies a set of jobs that are expressly prohibited for 14- and 15-year-olds. Federal law additionally prohibits the employment of children under age 18 in occupations identified by the Secretary of Labor to be especially hazardous based on injury and fatality data, which currently includes 17 occupations. In violation of these standards, some recent bills proposed by state legislators would authorize employers to hire children in hazardous industries like construction (2023 MN SF 375/HF 260) or to operate power-driven industrial machinery (2022 IA SF 2190).

- Establishing a subminimum wage. Federal law allows employers to pay young workers and students subminimum wages and excludes occupations often held by youth. Some states have considered bills to establish a subminimum wage for workers under a certain age, below the minimum wage required by federal or state law.

- Lowering alcohol service age. The minimum age to serve alcohol in most states is at least 18 years, but in recent years, pushed by industry lobbyists, several states have enacted or considered bills to lower the minimum age to serve alcohol, with one proposal in Wisconsin (2023 WI AB 286) contemplating a minimum age of 14.

- Weakening protections for homeschooled children. State laws vary regarding homeschool accountability and oversight. In some instances, homeschooling parents are not required to monitor their child’s academic progress or record it in any way. State deregulation of child labor laws may include further loosening of homeschool oversight, or take advantage of already weak regulations, to make it completely legal for a child’s education to be effectively abandoned. One proposal in Florida (2024 FL HB 49) explicitly allows homeschooled children to work during school hours.

- Preventing local governments from passing stronger child labor protections. Local communities should have the power to develop policies that reflect the values and needs of the people living there. Some states are also considering child labor legislation that would block local policies that strengthen child labor protections above a state standard, expanding a longer-standing and troubling pattern of state interference with local governments’ ability to strengthen labor standards.

See Table 1 for a summary of legislation to weaken child labor protections that have been considered since 2021.

Strategies for Organizing Against the Rollback of Child Labor Protections

In organizing against the campaign to deregulate child labor, state legislators should consider the following strategies:

- Center people. The people most impacted by these proposals should be the center of our work. Organize with community groups, parents, and children impacted by these laws. Worker centers, farmworker associations, student groups, and labor unions are valuable partners in public education, media engagement, legislative strategy, and coalition-building.

- Build coalitions. It is important to partner with advocacy on the ground. In addition to worker centers, farmworker associations, student groups, and labor unions, consider public educators and state public education advocates, faith organizations, and anti-poverty organizations as partners. Small businesses and responsible employers (for example, unionized construction contractors who take pride in maintaining high standards for safety and training) can also be key allies.

- Name opponents. Effective campaigns have a clearly identified and tangible opponent. Name who is financing these campaigns, as well as their financial contributions to lobbying and elections. This includes the FGA and their key financier billionaire Dick Uihlein, as well as the industry trade associations supporting these bills such as the state Chamber of Commerce, state Retail Federation and Restaurant Association, and the brand-sensitive corporations that make up their membership.

- Paint the big picture. Be clear about who is funding this campaign, the history behind this effort, and the interconnectedness between efforts to privatize public education while simultaneously rolling back child labor protections. These laws are about denying young people the freedom to decide their futures in exchange for exorbitant corporate profits.

- Use research and data. This report highlights research on the families most impacted by these laws, the deadly dangers associated with child labor, and the impact rolling back child labor has on overall worker wages, benefits, and safety. It is also important to understand the current exemptions in your state law, as well as federal law, in the specific industries the bill impacts. Gathering data on youth employment, high school completion, injury and fatality rates for young workers, and federal and state violations of child labor laws can also help to illustrate the realities of young workers in the economy. This helps debunk myths pushed by proponents, such as that these bills are simply about young people learning new skills or that they align with and do not violate federal law.

- Engage with unlikely allies. As noted, industry trade associations such as the Chamber of Commerce and Retail Federation are generally in support of these bills. However, individual companies may oppose them and can be invited in as allies in this effort. There may also be a need for public pressure campaigns to secure opposition from such unlikely allies.

- Engage with the media in coalition. Engaging the media on these bills in collaboration with partner organizations and coalitions is an important tactic to educate and organize the public. This includes traditional and nontraditional media, as well as non-English-speaking outlets.

- Learn from peers in other states. The campaign to roll back child labor protections is a national campaign rooted in the states; it is important that we don’t operate in state silos but instead learn from peers across the country facing the same legislation. Tools like amendments, questions for the bill sponsor, debate, and public testimony are already publicly available in many states and critical in building public opposition to these bills. State Innovation Exchange can support these efforts.

Table 1. State Child Labor Legislation

Note: This table summarizes the provisions of state legislation related to child labor identified by the authors as of February 9, 2024. The status of each bill reflected in this table may not reflect its current status.

Opportunities To Strengthen Child Labor Protections

State lawmakers have the power to take immediate action to protect young workers against the staggering uptick in child labor violations, especially among children working in dangerous industries. The following sections include examples of provisions that lawmakers may consider in developing a stronger framework for child labor protections in their states, drawn from bills that have been considered at the federal and state levels. In addition to legislation specific to child labor, this section also includes enforcement approaches from other areas of labor law that may be effective against child labor violations.

See Table 1 for a summary of bills referenced in the following sections, in addition to other bills with similar provisions.

Enhancing Labor Protections

State lawmakers have the power to counteract the spread of child labor deregulation by ensuring that state-level protections continue to prioritize the health, safety, and education of young workers. At a minimum, legislators in states where child labor protections are weaker than the FLSA should raise state standards to align with federal requirements.

- Establish labor protections for children that exceed federal standards. Federal child labor standards do not include time and hour restrictions for 16- and 17-year-olds, establish rest or meal break requirements, or require work permits for youth to be employed. Many states already have time and hour restrictions or occupational prohibitions that provide additional protections for young workers beyond what is required in the FLSA. Missouri lawmakers are considering a bill (2024 MO HB 1536) that would prohibit overnight shifts for 16- and 17-year-olds on school nights. In Michigan, where existing law already prohibits overnight shifts for 16- and 17-year-olds except if a deviation is granted by the state labor agency, legislators have introduced a bill (2023 MI HB 4932) that would narrow the circumstances in which a deviation may be granted to exclude certain hours or occupations that are “hazardous or injurious to the minor’s health or personal well-being.” Additionally, while most states already require that a work permit be issued to minors for employment, such requirements do not apply to all ages of minors or all occupations, and in most states, the permit includes no process for verifying the ages of minors.

- Repeal exceptions that allow minors to be paid less than minimum wage. In addition to increasing the state minimum wage for all workers, lawmakers can ensure that young workers are paid the same as their adult co-workers for performing the same work. Legislators in the 34 states and the District of Columbia, where state law allows subminimum wages or excludes youth from minimum wage protections, can enhance protections for young workers by repealing subminimum wage laws. Rhode Island lawmakers are considering a bill (2024 RI H 7172) that would repeal provisions of existing law that allow some minors under the age of 19 to be paid less than the state minimum wage.

Modernizing Agricultural Labor Protections

While federal law clearly identifies the certain occupations considered unsafe for children under 18, the law remains extremely weak when it comes to employment in agriculture: even children under the age of 12 can work on farms in certain circumstances. The exclusion of farmworkers from child labor protections, much like the exclusion of farmworkers and domestic workers from other areas of labor and employment law, has deep roots in slavery and subjugation in the name of profit.

Much of the progress that has been made to improve conditions for farmworkers, including children, has been the result of decades of sustained organizing by farmworkers and their allies across the country. Some of these efforts have yielded legally binding codes of conduct between farmworkers and employers, which prohibit child labor and provide other important standards for worker safety and dignity. The Fair Food and Milk With Dignity Codes of Conduct are two models; these may offer inspiration for policy change.

Lawmakers can bring protections for farmworkers into the 21st century by raising state standards to minimize the risks that children face in agricultural work.

- Limit the employment of children in agricultural work. Some states have already raised the minimum age for farmwork above the federal minimum for employment during and outside of school hours or under other specific circumstances, such as migratory labor. At the federal level, the Children’s Act for Responsible Employment and Farm Safety (CARE) Act (2023 US HR 4046) would align the minimum age and work hour standards for agricultural work with that of all other industries. In New York, lawmakers previously considered a bill (2022 NY A 9235) that would have raised the minimum age for agricultural labor to 16 and established new civil penalties for violations of oppressive agricultural child labor. Under the bill, a violation resulting in serious injury, serious illness, or death would be punishable by a penalty between $15,000 and $60,115 and/or five years of imprisonment, with the penalties doubling in instances where such violations are repeated or willful.

- Establish stronger protections for the most hazardous types of farmwork. State lawmakers may also consider establishing new protections that apply to the most serious hazards that children face in agricultural work. The federal CARE Act (2023 US HR 4046), for example, would authorize the Secretary of Labor to create new regulatory guidelines for pesticide exposure for children in farmwork. Legislators in Virginia (2022 VA HB 876) recently considered a bill that would have prohibited the employment of a child under the age of 18 in any work involving direct contact with tobacco plants or dried tobacco leaves, which are known to be a significant occupational health risk for children.

- Align labor protections for farmworkers with existing standards for other industries. Though not specific to protections for minors employed in agricultural labor, legislators can bring protections for all farmworkers into the 21st century by applying basic labor standards that already exist for all other workers to agricultural workers. Colorado lawmakers recently enacted legislation (2021 CO SB 87) that repealed provisions of state law that exempted farmworkers from wage and hour protections, in addition to granting agricultural workers the right to unionize, certain meal and rest breaks, and whistleblower protections.

Enhancing Enforcement and Penalties

The growing incidence of egregious child labor violations suggests that existing enforcement mechanisms—and the likelihood that enforcement will occur at all—are insufficient to deter employers from violating the law. For profit-driven corporations, the decision is simple math: one analysis of DOL data found that federal penalties for minimum wage and overtime violations are “often relatively small when weighed against the small probability of detection of the violation for many firms.” In other words, an effective enforcement strategy must consider the cost of noncompliance in addition to maintaining a credible ability to enforce.

Increasing Penalties

Research shows that higher penalty amounts are an effective deterrent for labor violations; one study comparing minimum wage violations with state employment laws across all 50 states and the District of Columbia found that “the stronger the state’s employment laws, the lower the incidence of minimum wage violations…states that implemented the strongest penalties—treble damages—experienced statistically significant drops in violation rates.”

- Establish strong civil and criminal penalties, including minimum penalties and damages payable to aggrieved workers. State lawmakers can consider proposals that would impose harsher civil and/or criminal penalties or establish minimum penalty amounts to ensure that all violations are met with an appropriate financial penalty. The Children Harmed in Life-Threatening or Dangerous (CHILD) Labor Act (2023 US HR 6079) would increase the existing federal maximum civil penalty amount tenfold and increase the maximum criminal penalty by a factor of 75 to $750,000. Another federal proposal, the Stop Child Labor Act (2023 US S 3051), would establish a new minimum civil penalty of $5,000 and increase the maximum penalty from $11,000 to $132,270. Legislators in Virginia are considering a bill (2024 VA HB 100) that increases the maximum civil penalty for child labor violations resulting in serious injury or death from $10,000 to $25,000 per violation, in addition to establishing a new minimum civil penalty of $500 and raising the maximum civil penalty from $1,000 to $2,500 for all other violations. Under existing California law, violations of child labor laws are subject to civil penalties (Cal. Lab. Code § 1288), ranging from a minimum of $500 to a maximum of $10,000 per violation, in addition to criminal penalties (Cal. Lab. Code § 1303), which carry a minimum fine of $1,000, up to a maximum fine of $10,000 for willful violations. Importantly, an effective penalty regime should also ensure that children subject to child labor violations receive monetary compensation in the form of damages or a portion of assessed penalties.

- Enhance penalties for egregious violations. Under federal law, child labor violations that cause serious injury or death or willful or repeated violations that cause serious injury or death are punishable by a higher maximum civil penalty; state lawmakers can consider a similar approach that heightens penalty amounts for the worst offenses. For example, the CHILD Labor Act (2023 US HR 6079) would double maximum penalty amounts for repeated or willful violations, violations involving employment in a hazardous occupation or place of work, violations occurring within 10 years of the final disposition of another violation, and for employers that have employed more than 10 children in a violation. Michigan lawmakers are considering legislation (2023 MI HB 4932) that would create a new felony offense for violations that result in death or great bodily harm, punishable by up to five years of imprisonment for a first offense, up to 10 years for a second offense, and up to 20 years for a third or subsequent offense. In California, severe violations, such as underaged employment in hazardous occupations, employment in excess of daily hour limits, or other violations that present an imminent danger to the youth, are subject to harsher civil penalties as Class A violations (Cal. Lab. Code § 1288(a)). Class A violations involving minors 12 years of age or younger are further subject to a minimum civil penalty of $25,000 and a maximum of $50,000 per violation (Cal. Lab. Code § 1311.5).

Enhancing Enforcement

State lawmakers can also ensure that more employers are compelled to comply with child labor laws by the plausible belief that officials have the capacity to enforce the law. In order to be effective, an enforcement regime must give aggrieved workers the confidence that they will be protected and made whole throughout the process of an investigation.

- Establish anti-retaliation protections for workers. Lawmakers can consider applying anti-retaliation protections to child labor laws, which may include establishing a rebuttable presumption that retaliation has occurred under certain circumstances, clearly defining types of protected activity or prohibited adverse actions, providing for increased damages when retaliation occurs, and ensuring that workers can receive injunctive relief before the conclusion of any investigation. For example, the federal CHILD Labor Act (2023 US HR 6079) would create a new anti-retaliation provision within the FLSA for any complaint or proceeding relating to child labor, punishable by a civil penalty of up to $75,000 per violation, in addition to legal or equitable relief. Under California’s Child Labor Protection Act (2014 CA AB 2288), youth workers who have suffered retaliation by their employer for filing a claim or civil action alleging a violation of child labor laws are entitled to treble damages.

- Extend statute of limitations for enforcement. Child labor violations involve children who may not come to understand their rights under the law for years to come; an extended timeline for enforcement may allow more investigations to come to light. The federal CHILD Labor Act (2023 US HR 6079) would extend the statute of limitations for child labor enforcement actions from 2 years to 10 years after the cause of action accrued. In California, lawmakers enacted a bill (2014 CA AB 2288) that “tolled” the statute of limitations on child labor violations, effectively suspending the clock on the statute of limitations to begin counting only once a worker reaches the age of majority.

- Expand administrative enforcement powers and deterrence strategies. State lawmakers can also give agency officials a wider range of enforcement tools throughout an investigation. States could consider establishing a state-level version of the “hot goods” provisions of federal labor law, which authorize the DOL to seek a court order to stop the shipment of goods produced in violation of the FLSA. The federal CHILD Labor Act (2023 US HR 6079) would authorize the Secretary of Labor to issue a stop work order that applies to one or more worksites of an employer in violation of child labor laws and requires that employers continue to compensate employees affected by the order. In Texas, lawmakers enacted a bill (2023 TX HB 2459) that authorized the state attorney general to seek injunctive relief against employers for repeated violations of child labor laws. Michigan lawmakers are considering legislation (2023 MI HB 4932) that would authorize the Director of the Department of Labor and Opportunity to bring an action to “obtain an injunction against a person who is engaging in, or about to engage in, a method, act, or practice” in violation of child labor laws. State lawmakers may also consider providing resources to labor agency officials that specifically provide the capacity to widely publicize child labor violations, including publicly naming offenders and sharing the results of investigations, such as the penalties assessed and other amounts recovered.

- Add labor enforcement capacity, particularly to support migrant children. State lawmakers can also consider approaches that add language and cultural capacity for working with children who are most affected by child labor violations, especially unaccompanied minors, in addition to training that ensures appropriate engagement in ways that do not re-traumatize children. Under California’s Dymally-Alatorre Bilingual Services Act, every state agency serving a “substantial number of non-English-speaking people” is required to employ a “sufficient number of qualified bilingual persons in public contact positions to ensure the provision of information and services to the public, in the language of the non-English-speaking person” and further requires the translation of any materials explaining public services. Michigan lawmakers recently passed legislation (2023 MI SB 382/HB 4720) that creates new requirements for state agencies to “provide meaningful language access to public services for individuals with limited English proficiency,” which includes oral language services and translation of documents.

Authorizing Enforcement on Behalf of the State

To add to state enforcement capacity, state legislators can also consider options that empower other entities to carry out enforcement actions on behalf of state officials. As recent reporting on the child labor crisis shows, migrant children and their families, concerned by the looming threat of deportation, are fearful of government officials. However, they may be eligible for programs like the Deferred Action for Labor Enforcement (DALE) program, which provides temporary protection against deportation and work authorization to noncitizen workers who have witnessed or been victims of labor violations.

- Establish grant funding for community-based enforcement. Lawmakers in California enacted a bill (2021 CA AB 138) that authorized a pilot program for community-based enforcement of labor violations against garment workers. Under the pilot, organizations are eligible to receive funds to provide educational programming, direct assistance to workers in filing a wage claim, and legal assistance to garment workers. Community enforcement programs (also known as co-enforcement and strategic enforcement partnerships) allow nongovernmental organizations, often worker organizations, legal nonprofits, or community-based organizations (CBOs), to closely collaborate with governmental enforcement agencies to improve enforcement outcomes. For the purposes of labor enforcement, this approach harnesses the trust that CBOs can build with workers—especially immigrant workers who may be wary of government officials—while also leveraging existing nongovernmental capacity and funding for other efforts that support effective enforcement, such as worker education and outreach.

- Authorize aggrieved employees to act as private attorneys general. Under California’s Private Attorneys General Act (PAGA), individual workers are authorized to file a claim on behalf of the state to recover civil penalties for labor violations. Aggrieved workers can bring enforcement actions on their own behalf and on behalf of other similarly situated employees, and civil penalties recovered under such actions are distributed between the workers and the agencies to support continued enforcement. In 2019, over $88 million in penalties were remitted back to the state labor agency through PAGA actions, allowing the agency to increase staffing and language efforts.

- Establish grant funding for enforcement by local prosecutors. In the state’s 2023-24 budget (2023 CA SB 101), lawmakers approved an $18 million appropriation for the Workers’ Rights Enforcement Grant Program, which provides funding to local prosecutors for the investigation and enforcement of state labor laws.

Establishing Legal Remedies for Aggrieved Children

As an additional layer of deterrence against the most grievous violations of child labor protections, lawmakers can also ensure that aggrieved children have pathways to seek adequate legal remedies against their employers.

- Create an exception to exclusive remedies available to workers who are injured or killed and increase benefits for illegally employed workers. Generally, workers and their families are limited to compensation through workers’ compensation as the sole remedy in cases where injury, illness, or death has occurred on the job. In exchange for benefits received through workers’ compensation insurance, workers lose the right to file lawsuits against their employers, who may only face an increased premium payment. Some states have created an exception to workers’ compensation as the exclusive remedy in cases where a child has been injured and employed in violation of child labor laws. Colorado lawmakers recently enacted legislation (2023 CO HB 1196) to clarify that in cases involving injury “during a week when the employer intentionally required the minor to work hours” prohibited by law, or when engaging in work prohibited by law, aggrieved children are entitled to pursue legal action against employers in addition to remedies through workers’ compensation. Under New Jersey law (N.J. Rev. Stat. § 34:15-10), minors who are injured while employed in violation of child labor laws are eligible for twice the amount of benefits available through workers’ compensation, with employers—not insurance carriers—being responsible for the extra compensation or death benefit.

- Establish a private right of action. At the federal level, the Stop Child Labor Act (2023 US S 3051) would establish a private right of action for minors who have been aggrieved by child labor violations and hold employers liable for compensatory and punitive damages of up to $250,000.

Extending Liability to All Entities That Profit from Child Labor

The increasingly complex nature of businesses that utilize temporary workers, staffing agencies, contract workers, independent contractors, and other work structure strategies “challenge the nearly century-old workplace policies built around direct, bilateral employment relationships.” Federal employment law generally holds that more than one entity may be held responsible as joint employers for the purposes of labor violations. In announcing its Interagency Child Labor Task Force, the DOL recently signaled that its enhanced enforcement efforts would apply scrutiny to violations committed by entities within an employer’s supply chain, including contractors or staffing agencies. At the state level, legislators can extend liability to include the most powerful and well-resourced entities that have escaped accountability.

- Establish lead corporation liability for violations committed within supply chains. At the federal level, the CHILD Labor Act (2023 US HR 6079) creates a new standard for “secondary oppressive child labor,” which creates new responsibilities for employers to take steps to ensure that contractors and subcontractors are compliant with child labor laws. Though not specific to child labor violations, lawmakers in Minnesota recently enacted an omnibus labor bill (2023 MN SF 3035) to hold construction contractors liable for wage and hour violations committed by a subcontractor. In California, such laws exist to extend liability for labor violations committed by labor contractors (2014 CA AB 1897); contractors in the long-term care, janitorial, and gardening industries (2015 CA SB 588); contractors on private construction projects (2017 CA AB 1701); major retailers for shipping logistics contractors (2018 CA SB 1402); and fashion brands for claims made by garment workers employed by manufacturers or contractors (2021 CA SB 62).

- Establish joint liability for franchisors and franchisees. Licensing agreements that allow independent owners, or franchisees, to operate businesses under the brand of a franchisor are typically comprehensive and precisely drafted to ensure brand consistency. However, franchise agreements are vague when it comes to compliance with labor laws to avoid liability, even though name-brand franchisors have the power and resources to protect against child labor violations. California lawmakers recently enacted a bill (2023 CA AB 1228) that, as introduced, would have made fast food franchisors jointly liable for labor violations committed in a franchisee’s establishment, though the provisions were stricken from the bill prior to passage. As proposed, the bill would have also voided any agreement between franchisors and franchisees to indemnify the franchisor from liability, allowed franchisees to sue franchisors if the terms of a franchise agreement prevent compliance with labor laws, and established a notice and cure process for franchisors regarding violations at franchisee establishments.

Establishing Public Procurement Requirements

State lawmakers can also amend public procurement processes to require strict compliance with child labor protections by government contractors and their supply chains.

- Establish strict disclosure and compliance requirements for public contracts. By setting a state standard for compliance with child labor laws, lawmakers can ensure that no taxpayer funds are spent on contractors that rely on illegal child labor. At the federal level, the Preventing Child Labor Exploitation Act (2023 US S 3139) would require federal contractors to annually disclose child labor and worker safety infractions within the preceding 3-year period, in addition to establishing a new criminal penalty for employers knowingly failing to make such disclosures. The bill additionally authorizes the Secretary of Labor to determine corrective measures that contractors which have committed a violation must complete in order to remain eligible for contracts and to publish a list of entities that are determined to be ineligible for federal contracts due to their history of serious, repeated, or pervasive labor violations or their failure to address corrective measures.

Supporting Education, Outreach, and Coordination of Services

Adequate enforcement of any labor law requires that workers are supported with knowledge that empowers them to exercise their rights. In the case of children, who are new to the workforce and may be unaware of their rights under child labor laws, education and outreach efforts can yield long-term benefits in a workforce well-versed in their rights. States can also fill a critical role by identifying service gaps that exist for children vulnerable to labor exploitation, especially migrant children and children in families with language or literacy barriers.

- Develop education and outreach programming for children and families. States can leverage school systems as an access point to ensure that children and their families are aware of their rights under the law. California lawmakers recently enacted a bill (2023 CA AB 800) designating one week as Workplace Readiness Week, during which high schools provide information to students on their rights as workers. The bill also requires that minor work permits include information on workers’ rights in “plain, natural terminology easily understood by the pupil.”

- Support coordination among labor officials, social services, and immigrant legal services. Recent reporting shows that in many instances, children subject to child labor violations are often in an extremely precarious and even captive position, in danger of deportation or retaliation against family members in small company towns or eviction when their employer is also their landlord. To minimize barriers to federal programs that offer legal relief from deportation and material assistance with basic needs, lawmakers can lead the coordination of resources across state agencies and with community-based organizations to develop supports that are sensitive to the distrust that families may have for government officials and to the traumatic experiences of young workers.

Conclusion

Industry-driven attacks on child labor standards rely on a false narrative that children universally have the opportunity to “choose” a job where they can learn important lessons for adulthood and “sock away” savings in a Roth IRA. And yet, that narrative couldn’t be further from reality for the children who would be most affected by the deregulation of child labor. As recent reporting and data show, the children most subject to child labor violations have no good choices; they have only the choice to survive.

Trapped in the jaws of our nation’s profit-driven economy and brutally inhumane immigration system, both designed by a relentless corporate lobbying machine that has captured statehouses and courts, migrant children are pushed into the shadows where they are exploited without recourse. In some of the most shocking investigations, employers receive a slap on the wrist, if any at all, and continue operating with their reputations and profit margins intact. Even in cases of injury and death, these children’s families are not afforded the dignity of any measure of accountability or care.

In defending against the corporate conspiracy to deregulate child labor, state legislators should be clear that the campaign is just one piece of a massive and generational project to remake the economy into one that gives corporations license to extract exorbitant profits from increasingly unregulated and dangerous child labor. Other critical pieces of the destructive plan seek to eviscerate the social safety net to ensure that workers have no choice when faced with unsafe and abusive working conditions; to dismantle critical institutions like public schools by robbing taxpayer coffers to pay for colossal corporate tax subsidies; and by demonizing and punishing immigrants, to create a class of workers who suffer violations in silence for fear of deportation and family separation.

Additional Resources

Economic Policy Institute

- Child Labor Laws Are Under Attack in States across the Country: Amid Increasing Child Labor Violations, Lawmakers Must Act to Strengthen Standards (December 2023)

- Youth Subminimum Wages and Why They Should Be Eliminated: Young Workers Face Pay Discrimination in 34 States and DC (January 2024)

- Florida Legislature Proposes Dangerous Rollback of Child Labor Protections: At Least 16 States Have Introduced Bills Putting Children at Risk (November 2023)

- As Some States Attack Child Labor Protections, Other States Are Strengthening Standards (November 2023)

- States across the Country Are Quietly Lowering the Alcohol Service Age: An Industry Already Rife with Abuse—Including Child Labor Law Violations—Would Like Your Server to Be an Underage Teenager (July 2023)

- Iowa Governor Signs One of the Most Dangerous Rollbacks of Child Labor Laws in the Country: 14 States Have Now Introduced Bills Putting Children at Risk (June 2023)

Migration Policy Institute

- Four Strategies to Improve Community Services for Unaccompanied Children in the United States (December 2022)

- Strengthening Services for Unaccompanied Children in U.S. Communities (June 2021)

Acknowledgements

A special thank you to Jenn Round, the Director of Beyond the Bill at the Workplace Justice Lab@Rutgers University, for her insightful comments and valuable improvements to this publication.